by The CE Shop Team

How Biden’s Jobs & Infrastructure Plan Would Affect Housing | The CE Shop

President Biden Commits to Addressing Affordable Housing Crisis

President Joe Biden’s $2.3 trillion jobs and infrastructure proposal includes a $213 billion investment in affordable housing, pledging to “build, preserve, and retrofit more than two million homes and commercial buildings to address the affordable housing crisis.”

The proposal, called the American Jobs Plan, has faced significant Republican opposition since it was released in March. It’s one of two sweeping economic initiatives that Biden has introduced in his first few months as president. The second, the $1.8 trillion American Families Plan, focuses on children, families, and education.

Biden’s Plan Addresses “Severe Shortage of Affordable Housing”

“There is a severe shortage of affordable housing options in America,” the American Jobs Plan says. “Millions of families pay more than half their income on rent, and home energy costs are a significant concern for American renters as well. And, across the country, people are struggling to purchase their first home.”

Soon after the proposal was unveiled, National Association of Realtors® President Charlie Oppler released a statement of support, praising the Biden administration for recognizing the importance of affordable housing.

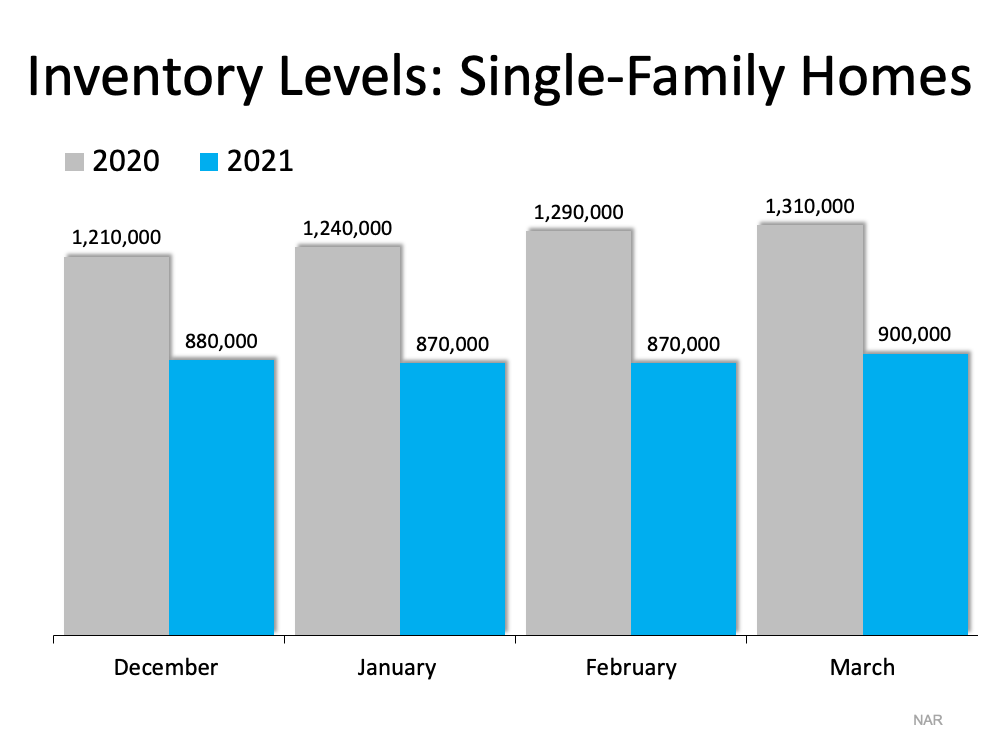

“NAR thanks President Biden and his administration for recognizing that housing represents a critical piece of our nation’s overall infrastructure,” Oppler said. “While a lack of inventory and rising prices continue to limit opportunities for homeownership — especially for younger Americans and minority populations — policies that support nationwide housing affordability are now more important than ever.”

Oppler also emphasized the importance of the plan’s investment in broadband internet access. The American Jobs Plan promises to “bring affordable, reliable, high-speed broadband to every American, including the more than 35% of rural Americans who lack access to broadband at minimally acceptable speeds.”

The statement says that the National Association of Realtors® supports the creation of a comprehensive national policy to stimulate the deployment of broadband in underserved areas, increase data speeds, and lower broadband prices.

“Broadband access is no longer a luxury, it is a critical utility,” Oppler said. “That was true before the pandemic, and even more so now.”

What’s in the American Jobs Plan?

The proposal identifies five ways that the $213 billion would be used to address the affordable housing crisis.

In addition to creating more affordable housing, Biden takes aim at “exclusionary zoning laws and harmful land-use policies” such as minimum lot sizes, mandatory parking requirements, and prohibitions on multi-family housing, arguing that they “have inflated housing and construction costs and locked families out of areas with more opportunities.”

Also, because “years of disinvestment have left our public housing in disrepair,” Biden is calling on Congress to allocate $40 billion to improve the infrastructure of the public housing system in the United States.

“The President’s plan will help address the growing cost of rent and create jobs that pay prevailing wages, including through project labor agreements with a free and fair choice to join a union and bargain collectively,” the plan says.

The American Jobs Plan would:

- Produce, preserve, and retrofit more than a million affordable, resilient, accessible, energy-efficient, and electrified housing units.Through targeted tax credits, formula funding, grants, and project-based rental assistance, the plan would extend affordable housing rental opportunities to underserved communities nationwide, including rural and tribal areas.

- Build and rehabilitate more than 500,000 homes for low- and middle-income homebuyers.Biden is calling on Congress to pass the Neighborhood Homes Investment Act (NHIA). Offering $20 billion worth of NHIA tax credits over the next five years would result in approximately 500,000 homes being built or rehabilitated, creating a pathway for more families to buy a home and start building wealth.

- Eliminate exclusionary zoning and harmful land-use policies.Biden is calling on Congress to enact a new competitive grant program that awards flexible and attractive funding to jurisdictions that take concrete steps to eliminate such needless barriers to producing affordable housing.

- Address long-standing public housing capital needs.Biden is calling on Congress to invest $40 billion to improve the infrastructure of the public housing system. This funding would address critical life-safety concerns, mitigate imminent hazards to residents, and undertake energy efficiency measures that will significantly reduce ongoing operating expenses. The plan says that these improvements would especially benefit women, people of color, and people with disabilities.

- Put union building trade workers to work upgrading homes and businesses to save families money.The plan would upgrade homes through block grant programs, the Weatherization Assistance Program, and by extending and expanding home and commercial efficiency tax credits. It also would establish a $27 billion Clean Energy and Sustainability Accelerator to mobilize private investment into distributed energy resources; retrofits of residential, commercial, and municipal buildings; and clean transportation. These investments would have a particular focus on disadvantaged communities that have not yet benefited from clean energy investments, the plan says.

For more information on the proposal, you can read it in full on the White House website.

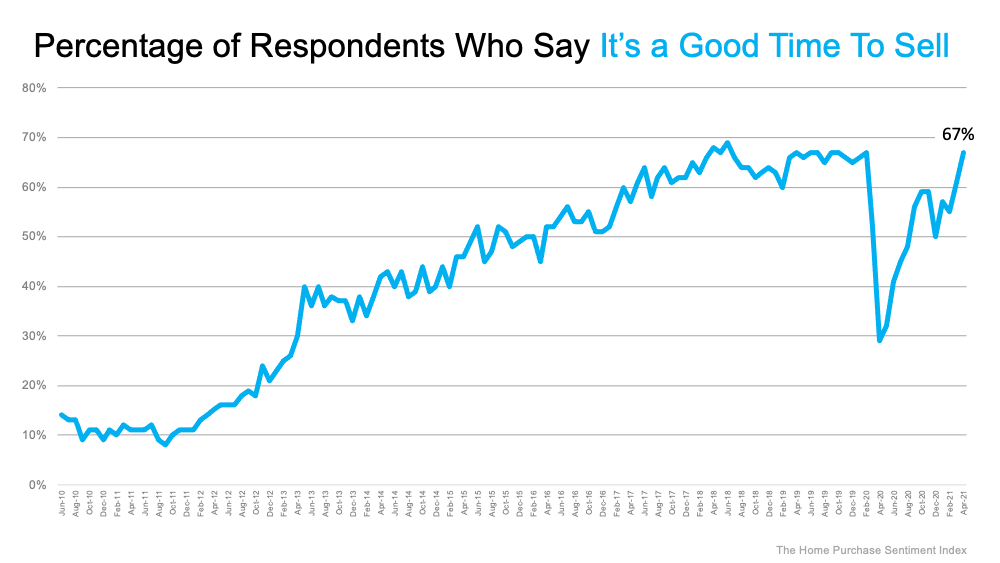

Impact on the Housing Market

Although the American Jobs Plan addresses many of the difficulties that low-income homebuyers and renters face in the housing market today, some experts caution that it doesn’t do enough to solve the crisis.

“It’s a historic amount of money, but we have a historic-size problem, and even this amount of money is not going to solve the problem,” David Dworkin, president of the National Housing Conference, told HousingWire.

Some say that even if the plan is passed, it might not be enacted quickly enough to meet the urgent need.

“Anything that can help increase the number of housing units is a good thing. And the consideration of enhancing the affordable choices is vital,” said Tim Sullivan, senior managing principal at Zonda, a housing market research firm, in an interview with Forbes. “Is this sufficient? Probably not since we need the additional housing now, and given the speed at which the government moves, I think there will be a lag in bringing this product to market.”

![When It Comes To Selling a House, Your Time Is Money [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/05/13143229/20210514-MEM-1046x2286.png)