![Waiting To Buy a Home Could Cost You [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/07/29150353/20210723-MEM-1-1046x2403.png)

Some veterans are finding it difficult to obtain a home in today’s market. According to the National Association of Realtors (NAR):

“Conventional conforming mortgages (mortgages that conform to guidelines set by Fannie Mae and Freddie Mac), accounted for 74% of mortgages obtained by homebuyers in May 2021, an increase from about 65% during 2018 through 2019…The share of VA-guaranteed loans has also decreased to 7% in May 2021 from about 10% in past years.”

Recent data in the latest Origination Insight Report from Ellie Mae sheds light on the continuation of this trend. Below, we can see just how small of a share of total financing VA loans made up in June of 2021, according to that Ellie Mae report:The drop in VA loan usage can be attributed to the difficulties veterans continue to face when buying a home. The NAR article elaborates:

“It is extremely difficult for FHA/VA buyers to get accepted in a multiple offer situation. They are on the bottom of the hierarchy.”

One contributing factor is that buyers with VA loans can’t waive certain contingencies. However, just because a certain contingency must be present for a particular buyer doesn’t mean that buyer’s offer shouldn’t be considered.

As a seller, it’s important to consider every offer in front of you regardless of loan type. If you’re selecting an offer because some contingencies are waived, keep in mind that it doesn’t always mean the offer is what’s best for you.

Buyers who can’t waive specific contingencies may adjust other terms in their offer to make it more appealing to sellers. This may depend on several factors, including their loan type and location, but a motivated buyer and their agent will do everything they can to present an offer that’s as appealing to you as possible.

Ultimately, you should make sure you take time to really understand the terms of their offer and see the big picture. Working with a driven buyer who’s motivated to purchase your house may provide a better opportunity for you to reach your overall best option and what’s most important to you.

If you’re ready to sell, let’s connect. Together, we can make sure you understand the terms of all offers so you can give each one fair consideration, including those buyers using a VA loan. Our veterans sacrifice so much for our country. They’ve earned our gratitude and should have the same opportunity to obtain the home of their dreams.

With forbearance plans about to come to an end, many are concerned the housing market will experience a wave of foreclosures like what happened after the housing bubble 15 years ago. Here are four reasons why that won’t happen.

After the last housing crash, about 9.3 million households lost their home to a foreclosure, short sale, or because they simply gave it back to the bank.

As stay-at-home orders were issued early last year, the overwhelming fear was the pandemic would decimate the housing industry in a similar way. Many experts projected 30% of all mortgage holders would enter the forbearance program. Only 8.5% actually did, and that number is now down to 3.5%.

As of last Friday, the total number of mortgages still in forbearance stood at 1,863,000. That’s definitely a large number, but nowhere near 9.3 million.

Of the 1.86 million homeowners currently in forbearance, 87% have at least 10% equity in their homes. The 10% equity number is important because it enables homeowners to sell their houses and pay the related expenses instead of facing the hit on their credit that a foreclosure or short sale would create.

The remaining 13% might not all have the option to sell, so if the entire 13% of the 1.86M homes went into foreclosure, that would total 241,800 mortgages. To give that number context, here are the annual foreclosure numbers of the three years leading up to the pandemic:

The probable number of foreclosures coming out of the forbearance program is nowhere near the number of foreclosures coming out of the housing crash 15 years ago. The number does, however, draw a similar comparison to the three years prior to the pandemic.

When foreclosures hit the market in 2008, there was an excess supply of homes for sale. The situation is exactly the opposite today. In 2008, there was a 9-month supply of listings for sale. Today, that number stands at less than 3 months of inventory on the market.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains when addressing potential foreclosures emerging from the forbearance program:

“Any foreclosure increases will likely be quickly absorbed by the market. It will not lead to any price declines.”

Just last Friday, the White House released a fact sheet explaining how homeowners with government-backed mortgages will be given further options to enable them to keep their homes when exiting forbearance. Here are two examples mentioned in the release:

When evaluating the four reasons above, it’s clear there won’t be a flood of foreclosures coming to the market as the forbearance program winds down.

As Ivy Zelman, founder of the major housing market analytical firm Zelman & Associates, notes:

“The likelihood of us having a foreclosure crisis again is about zero percent.”

Hey! Look at this sweetie! I am half in love with this house. We’re open Saturday AND Sunday. Check us (and the house) Saturday from 11-1 and Sunday 1-3. 1203 NE Webster, Portland, OR 97211

The ultimate timeline ensures the smoothest of transitions.

From HouseLogic

A real yard. Closets bigger than your average microwave. The freedom to decorate however you darn well please! Making the switch from renting to owning is exhilarating, but many rookie homebuyers find the process trickier to navigate than they expected.

This is why we created our First-Time HomeBuyer Checklist. The 12-month timeline will help you sidestep common mistakes, like paying too much interest or getting stuck with the wrong house. (Yep, it happens!)

Check your credit score. Get a copy of your credit report at annualcreditreport.com. The three credit bureaus (Equifax, Experian, and TransUnion) are each required to give you a free credit report once a year. A Federal Trade Commission study found one in four Americans identified errors on their credit report, and 5% had errors that could lead to higher rates on loans. Avoid last-minute bombshells by checking your score long before you’re ready to make an offer. And work diligently to correct any mistakes.

Determine how much you can afford. Figure out how much house you can afford and want to afford. Lenders look for a total debt load of no more than 43% of your gross monthly income (called the debt-to-income ratio). This figure includes your future mortgage and any other debts, such as a car loan, student loan, or revolving credit cards.

There are plenty of calculators on the web to help you determine what you can afford. If you’re pushing the limits, start reducing your debt-to-income ratio now. To get a reality check on what you may actually be spending every month, use this worksheet.

Lenders are happy to lend you as much as your debt load allows. But will that amount make you house poor? Ask yourself, how much house do I really want to afford?

Make a down payment plan. Most conventional mortgages require a 20% down payment. If you can swing it, do it. Your loan costs will be much less, and you’ll get a better interest rate. If, however, you’re not quite able to save the full amount, there are many programs that can help. FHA offers loans with only a 3.5% down payment. But they require mortgage insurance premiums, which will drive up your monthly payments. The U.S. Department of Housing and Urban Development (HUD) provides a list of nonprofit homebuying programs by state. Also check with credit unions; and your employer might even have an assistance program.

As you’re planning your savings strategy, keep in mind that banks like you to “season” your money. That is, they like to see that you’ve had stable funds in your account for 60 to 90 days before applying for a loan. Don’t worry: You can still use a financial gift from a family member or bonus received near the time you buy.

Prioritize what you most want in your new home. What’s most important in your new home? Proximity to work? A big backyard? An open floor plan? Being on a quiet street? You’ll make a much better decision on what home to buy if you focus on your priorities. If it’s a joint decision, now is the time to work out any differences to avoid frustration and wasted time. Perhaps most important: Know what trade-offs you’re willing to make.

Research neighborhoods and start visiting open houses. But now’s when the fun begins, too. Use property listing sites, such as realtor.com, to find out about neighborhoods, public transport, and cost of living.

Start visiting open houses to get an idea of what kind of homes are in your price range and what neighborhoods appeal the most. Seeing potential homes will also keep you motivated to continue reducing your debts and saving for your down payment.

Budget for miscellaneous homebuying expenses. Buying a home has some miscellaneous upfront costs. A home inspection, title search, propery survey, and home insurance are examples. Costs vary by locale, but expect to pay at least a few hundred dollars. If you don’t have the cash, start saving now.

Start a home maintenance account. Speaking of saving, start the good habit now of putting a little aside each month to fund maintenance, repairs, and home emergencies. It’s bad enough to have to call a plumber. It’s worse if you’re paying credit card interest on that plumbing bill.

Collect your loan paperwork. Banks are very particular when it comes to mortgage loans. They demand a lot of paperwork. What they’ll want from you includes:

If you start collecting these documents now, it’ll lessen the stress when it’s time to get your loan. Bonus: Looking closely at your loan documents each month will also help you stay focused on saving for your down payment and keeping your debt-to-income ratio low.

Research lenders and REALTORS®. Start interviewing REALTORS®, specifically buyers’ agents. A buyer’s agent will work in your best interest to find you the right property, negotiate with the seller’s agent, and shepherd you through the closing process. Your agent also can be instrumental in finding a lender who’s familiar with first-time home buyer programs.

Even better, look for a mortgage broker, who will shop for a competitive loan rate for you among multiple lenders, unlike a bank, which can only offer its own products.

Get pre-approved for your loan. At this point, if you’ve been following this timeline, your credit score, paperwork, and down payment should be on track. You’ve done your research on lenders and buyers’ agents. Now it’s time to start working with them. First you’ll need to get pre-approved for a mortgage.

Make an appointment with your lender or mortgage broker and bring all your paperwork. He’ll run a credit check on you and tell you how much of a loan you’re approved for. It often makes sense to borrow less than the maximum the lender allows so you can live comfortably. Draft a budget that accounts for mortgage payments, insurance, maintenance, and everything else you have going on in your life.

Start shopping for your new home. One you’re pre-approved, the buyer’s agent you’ve chosen will be able to target homes that meet your priorities in your price range. This way you won’t be wasting time looking at homes you can’t afford.

Make an offer on a home.It usually takes at least four to six weeks to close on a home. So if you have a firm move-out date, allow enough time to deal with any hiccups that can delay closing.

Get a home inspection. One of the first things you’ll want to do after an offer is accepted is have a home inspector look at the property. If the home inspector finds something that needs repair, that’s a common example of something that can delay closing.

Triple-check that all your financial documents are in order and review all lending documents before closing. You’re in the home stretch! If you’ve been keeping your documents up to date, and your down payment is in reserve, these final steps are the easiest. Reviewing the mortgage documents is probably the most difficult. Your agent can help guide you through them.

Get insurance for your new home. Don’t forget to secure insurance before closing. You’ll need to bring proof of insurance to closing.

Do a final walk-through. Do a final walk-through of your new home, usually a day or two before closing, to make sure the home is in the shape you and the seller have agreed upon.

Get a cashier’s check or bank wire for cash needed at closing. Make sure you get an exact amount of cash needed for closing. You’ll get that number a few days before closing so you can secure a cashier’s check or arrange to have the money wired. Regular checks aren’t accepted.

That’s it. Congratulations!

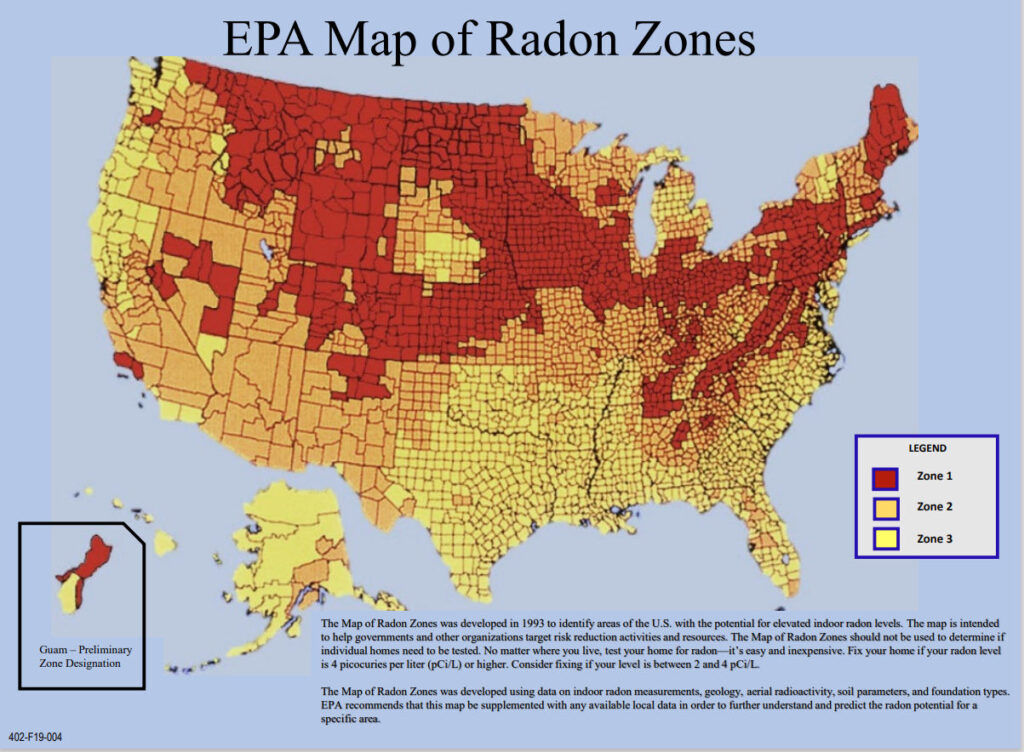

Hi, I’m Christy Walton with RE/MAX Select in Portland, Oregon. Welcome to Select’s Home Science School. Today, we’re talking Radon.

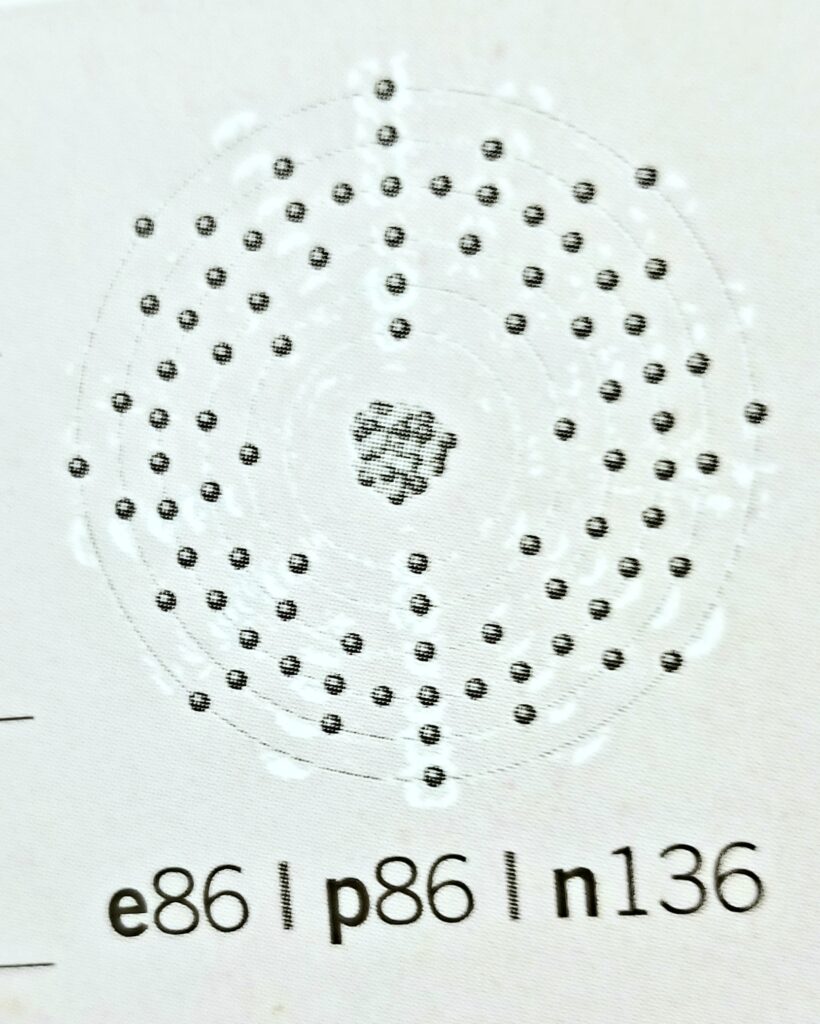

What, exactly, is Radon?

Radon is produced by the radioactive decay “daughter” of radium, which is itself a daughter of uranium and is common in all soils and stone. The radon naturally escapes from the soil or rock where it is generated and enters surrounding water and air or is generated during uranium ore mining or in the production of uranium fuel (but that’s a different story.) Its most stable isotope, radon-222 has a half-life of 3.8 days, which is relatively fast, but because uranium and radium are so prevalent in the Earth, radon will pretty much always be an issue.

Some of radon’s own decay daughters have exceptionally short half-lives and it emits ionizing radiation in the form of alpha particles, as well as beta, and gamma particles. They are solids.

What’s the problem?

Radon is radioactive. Unlike its parent elements, radon is a gas under standard conditions – an inert, heavy, noble gas. Radon is colorless, odorless, and tasteless, which means that it isn’t detectable by normal human senses and people don’t know that it’s there and they don’t know they are inhaling it.

When radon is inhaled, most is exhaled. Radon is constantly decaying, even during our respiration. The alpha particles shed by radon daughters can’t travel far and can’t penetrate the skin but as electrostatically charged solids, they attach to dust particles and cling to the lungs, invading cell nuclei, and doing damage that can lead to lung cancer or chronic lymphocytic leukemia. Stomach and other internal organ cancers are the results of radon-contaminated water. Research suggests that children who live in homes with high radon levels may have an increased risk of developing childhood acute lymphoblastic leukemia.

Per the Environmental Protection Agency, “Radon has been classified as a known human carcinogen and has been recognized as a significant health problem by groups such as the Centers for Disease Control, the American Lung Association, the American Medical Association, and the American Public Health Association.” Epidemiological studies have shown a clear link between breathing high concentrations of radon and the incidence of cancer.

The National Academy of Sciences stated that radon is the second leading cause of lung cancer after smoking and is responsible for between 15,000 and 22,000 lung cancer deaths every year. To bring that home, that’s about 58 deaths per day. Radon is the number one cause of lung cancer in non-smokers; about 2,900 lung cancer deaths occur among people who have never smoked. There are approximately 180 U.S. deaths per year from radon contaminated well water. Also, the relationship between radon and smoking is synergistic, meaning that smokers with exposure to radon have an even higher incidence of lung cancer.

Before you ask, with current technology, radon in human tissue is not detectable by routine medical testing. However, several of its decay products can be detected in urine, in lung and bone tissue, and by breath tests.

In Europe, radon concentration in the atmosphere is usually measured in becquerel per cubic meter. In the U.S. we measure in picoCuries with one picoCurie per liter of air equaling thirty-seven becquerel per cubic meter of air In the mining industry and when specifically discussing radon daughters, radon is measured in Working Levels.

As the map displays, radon concentration can differ widely from place to place. The red zone shows a county-wide screening average greater than 4 pCi/L, orange is between 2 and 4 pCi/L, and yellow is the lowest risk, at under 2 pCi/L. What the map doesn’t show is individual neighborhoods and homes which vary depending on hyperlocal geology, season – levels test higher when we heat our homes, atmospheric conditions, the structures built upon the earth, or if you’re standing in a uranium mine but is never zero. The Portland metro area is lit up bright red.

In the U.S. outside air typically contains very low levels of radon (about 0.4 picoCuries per liter of air). It builds up to higher concentrations in indoor air. The typical U.S. household concentration is 2.7 pCi/L. In Portland, we see levels vary from house to house and neighborhood by neighborhood. Large buildings that have many rooms may have varying radon levels in each room, even on the same floor.

The Environmental Protection Agency (EPA) set an action level of 4.0 pCi/L in homes and schools. In 1988, EPA and the U.S. Surgeon General issued a health advisory recommending that all homes below the third floor be tested for radon and fixed if the radon level is at or above 4 pCi/L, EPA’s national voluntary action level. The World Health Organization recommends that a home be mitigated when the radon level is 2.7 pCi/L (100 Bq/m3) or above. The American Society of Heating, Refrigeration, and Air Conditioning Engineers has set the lowest level, which suggests a radon action level of 2 pCi/L or less for commercial buildings and residences. The U.S. Mine Safety and Health Administration suggests the action level at 16 pCi/L (while miners are in underground mines). If you’re wondering why 4 was chosen by the EPA, I am happy to privately share a link that explains the costs of mitigation vs. medical costs.

As a note, 1 pCi/L of radon is equal to 2.5 cigarettes a day. The amount of radiation in 4.0 pCi/L of radon is equivalent to that in 100 chest X-rays and most hospitals only allow people to have four chest X-rays or .64 pCi/L each year. If a family whose home has radon levels of 4 pCi/L is exposed to approximately 35 times as much as much radiation as the Nuclear Regulatory Commission would allow if that family was standing next to the fence of a radioactive waste site.

Radon can enter your home through well water and in building or decorative materials made of concrete, stone, sand, or clay, with granite and concrete blocks being the biggest contributor of radon emanations from normal building materials.

In reality, most radon seeps up from the ground and concentrates in structures, like your house. Radon typically moves up through the ground to the air above and through cracks, holes, and pores in the foundation, joists, walls, and around pipes. It comes in through floor drains, unsealed sump pumps, and crawl spaces. Any place in your home that has contact with the earth is a possible entry point for radon. As a reminder, radon is invisible, odorless, and tasteless and most homes don’t have a sign flashing RADON PRESENT. So, we test for it.

There are two types of tests: passive and active. This is a passive test. I set these two bottles out in the lowest level of my home, seal the room for 2 to 90 days depending on the test, then send the test to a lab for analysis. No special training is needed for somewhere between $30-$50.

While home improvement stores do have do-it-yourself kits like this one, as a REALTOR, I highly suggest that homeowners hire someone to do the test for them to avoid any potential errors in setting, sending, or reading the test. I have a list of radon companies and home inspectors that I have worked with, but a quick search online will find someone.

Professional radon inspectors utilize active testing. The machines need power and can run constantly or take periodic measurements of both radon and atmospheric conditions over a specific amount of time, at least 48 hours. These tests can be both short and long-term if you want to make that investment. We tend to use a 48-hour test in our home buyer real estate inspections. The results are instant, but they are more expensive than a passive test. Also, small digital testing machines are available for purchase by homeowners.

If your home tests higher than 4 pCi/L, you should retest, just to be sure. You don’t want to take the next steps without knowing the levels.

So, now you’ve tested, what comes next?

If radon levels are over 4 pCi/l or the level that the homeowner requires, radon can be reduced. The EPA generally recommends methods that prevent the entry of radon, in one of four ways.

The most often utilized method is sub-slab-depressurization, also called soil suction or active soil depressurization by increasing under-floor ventilation.

There are advertised and lab-tested techniques for reducing the radon entry rate due to off-gassing or “exhalation” from natural product building materials, including aluminum foil, paint, and other sealants. However, there are predictable failure responses from most of the surface treatments. Sealing alone has not been found to work consistently or effectively.

Treatment systems using aeration or activated charcoal are available to remove radon from private wells.

When it comes to radon that seeps into the home from the ground, there are two types of mitigation systems – active and passive. The things to consider when choosing the correct system include estimated lowest radon levels, installation costs, operational costs, fan noise considerations, and the appearance of the system on the home.

A passive radon system is pretty much a pipe without an exhaust fan. A passive system typically runs from the basement floor, sump pit, or drain tile and exhausts through the roof. Passive radon systems rely on what’s referred to as the “stack effect” (which is actually one of the ways that I cool my house). What happens is that warm air rises, and cold air is brought in from outside. That cold air contains radon. The stack effect relies on air pressure differentials to move air and radon gas through the pipe from under the basement to the exhaust vent. It does work – in a perfectly sealed home where the cold air flows directly into the passive pipe. The stack effect, while it does cool your home, usually is not enough to significantly reduce radon levels and can make them worse.

An active radon mitigation system has an electric fan running 24/7 to create constant negative pressure throughout the system. The amount of electricity used is about the same as a traditional light bulb, depending on the size of the fan. The negative pressure pulls the radon from the soil beneath the house and through the radon system pipes where it vents it above the roof. It can reduce radon levels by up to 99%. One company even guarantees a post-install radon level of 1.7 pCi/L!

In homes with crawlspaces, a sheet of high-density plastic is laid on the earth as a radon barrier, and the suction pipes are laid beneath that to vent to the atmosphere. This type of soil suction is called submembrane suction.

The process of installing the mitigation system involves answering questions about location, soil composition, negative pressure, and suction. The company may need to core the basement floor to take readings. They will then create a lateral suction hole (hopefully outside) to test and build the system and then figure the size of the pipe and fan required because of the soil composition, then install them. It’s important to get the right sizes so there isn’t electrical waste, excessive noise, or risk of back drafting. During the installation process, the EPA demands that certain foundation cracks are sealed with polyurethane caulk to help create the vacuum needed for the mitigation system to work.

If your basement is unfinished, now’s the time to prep it to protect your family from radon. Look online to learn how.

The final note on radon is that homeowners should test every two years because levels and conditions change.

I’m Christy Walton with RE/MAX Select. If you have any questions about radon or the Portland real estate market, drop me a line at GoodnightChristy.com. Also, hit the like and subscribe buttons then check out my other videos on the fascinating world of real estate in Portland, Oregon. If you are looking for my research citations, check out my blog at ChristinaWalton.com

EPA

https://www.epa.gov/sites/default/files/2015-07/documents/zonemapcolor.pdf

Levels of Radon and Granite Building Materials, Akbar Abbasi

Submitted: November 28th 2016 Reviewed: June 2nd 2017 Published: November 29th 2017

DOI: 10.5772/intechopen.69987 https://www.intechopen.com/chapters/56368

Ohio Radon Mitigation LLC

https://www.ohiorm.com/common-questions-about-radon-and-radon-mitigation/understanding-radon-levels/

EPA Assessment of Risks from Radon in Homes,

United States Environmental Protection Agency, Office of Radiation and Indoor Air

EPA 402-R-03-003 2003

https://www.epa.gov/sites/default/files/2015-05/documents/402-r-03-003.pdf

Alarm New England

The Best 3 Radon Detectors on the Market and Why You Need One

24 Apr 2020

https://www.alarmnewengland.com/blog/best-radon-detectors

Marketing emails

JustRadon.com

Radon in Canada’s Uranium Industry March 2012

https://nuclearsafety.gc.ca/eng/pdfs/Fact_Sheets/Radon-Fact-Sheet_e.pdf

National Radon Program Services

Kansas State University

https://sosradon.org/Radon%20Basics

Childhood leukemia in areas with different radon levels: a spatial and temporal analysis using GIS

S Kohli, H Noorlind Bragec, O Löfmanc

https://jech.bmj.com/content/54/11/822

Home Radon Pros

https://www.homeradonpros.com/post/radon-levels-pittsburgh

Oregon Health Authority

Radon Gas: Environmental Public Health

https://www.oregon.gov/oha/PH/HEALTHYENVIRONMENTS/HEALTHYNEIGHBORHOODS/RADONGAS/Pages/Radon-FAQs.aspx

https://www.researchgate.net/profile/David-Wyk

Radon in Water, Air, and Soil

Written by Mr. Brian Oram, PG

https://water-research.net/index.php/radon

Radon Levels Explained

https://www.ohiorm.com/common-questions-about-radon-and-radon-mitigation/understanding-radon-levels/

EPA Facts about Radon

https://semspub.epa.gov/work/HQ/176336.pdf

PASSIVE RADON MITIGATION SYSTEM VS. ACTIVE RADON MITIGATION SYSTEM

Lifetime Radon Solutions

http://www.lifetimeradon.com/GasRemovalInformation/New-Construction-Radon-Systems

A comparison of the radon concentrations and lung cancer mortality rates in the United States.

https://www.researchgate.net/figure/A-comparison-of-the-radon-concentrations-and-lung-cancer-mortality-rates-in-the-United_fig3_327773208/download

Radon Mitigation Auburn & King County

Northwest Foundations Auburn

https://foundationrepairauburn.com/radon-mitigation-auburn/

Daily Mail

https://www.dailymail.co.uk/health/article-3330132/The-hidden-killer-home-Odourless-gas-linked-lung-cancer-causes-thousands-deaths-year.html

I Know My Radon Level

Interior Health

https://www.interiorhealth.ca/YourEnvironment/RadonGas/Pages/I-Know-My-Radon-Level.aspx

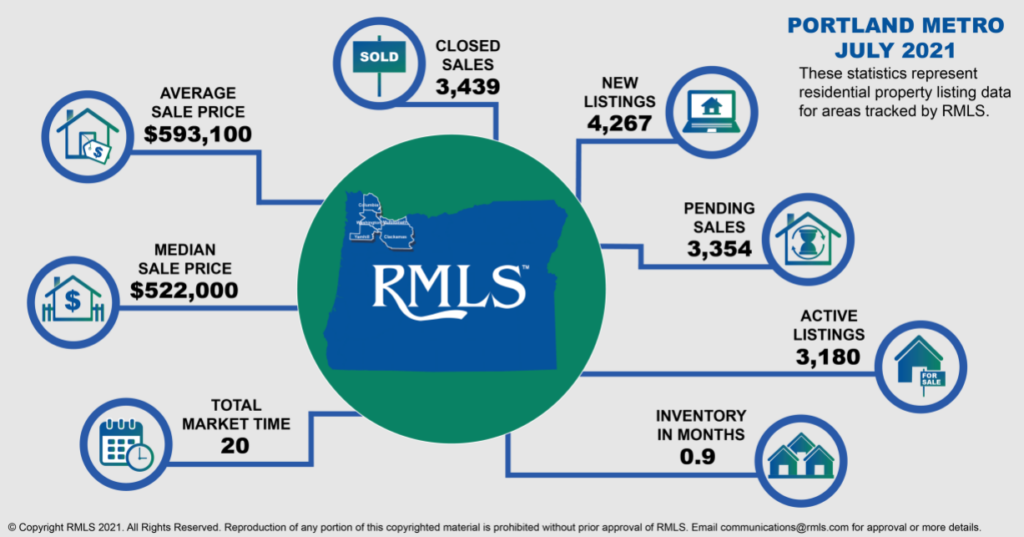

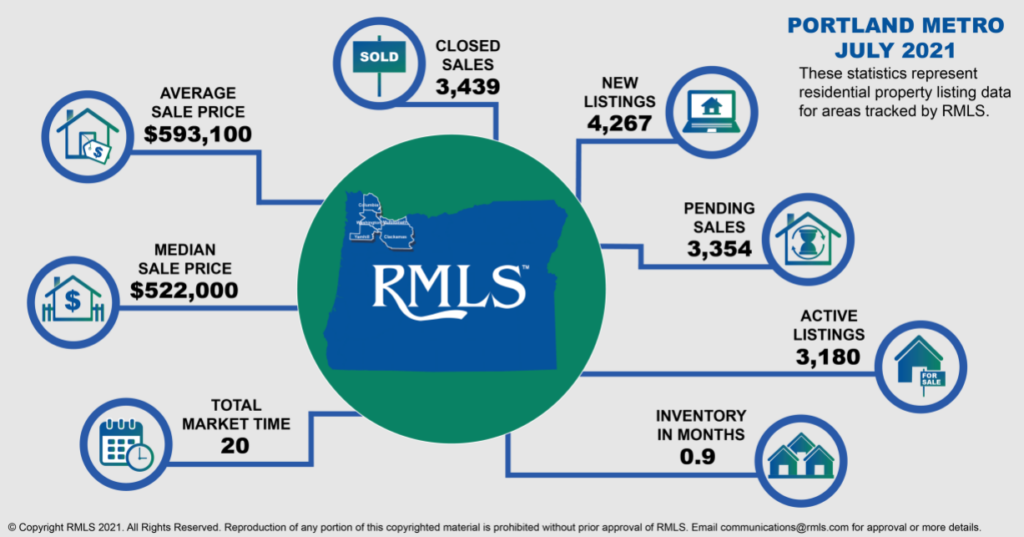

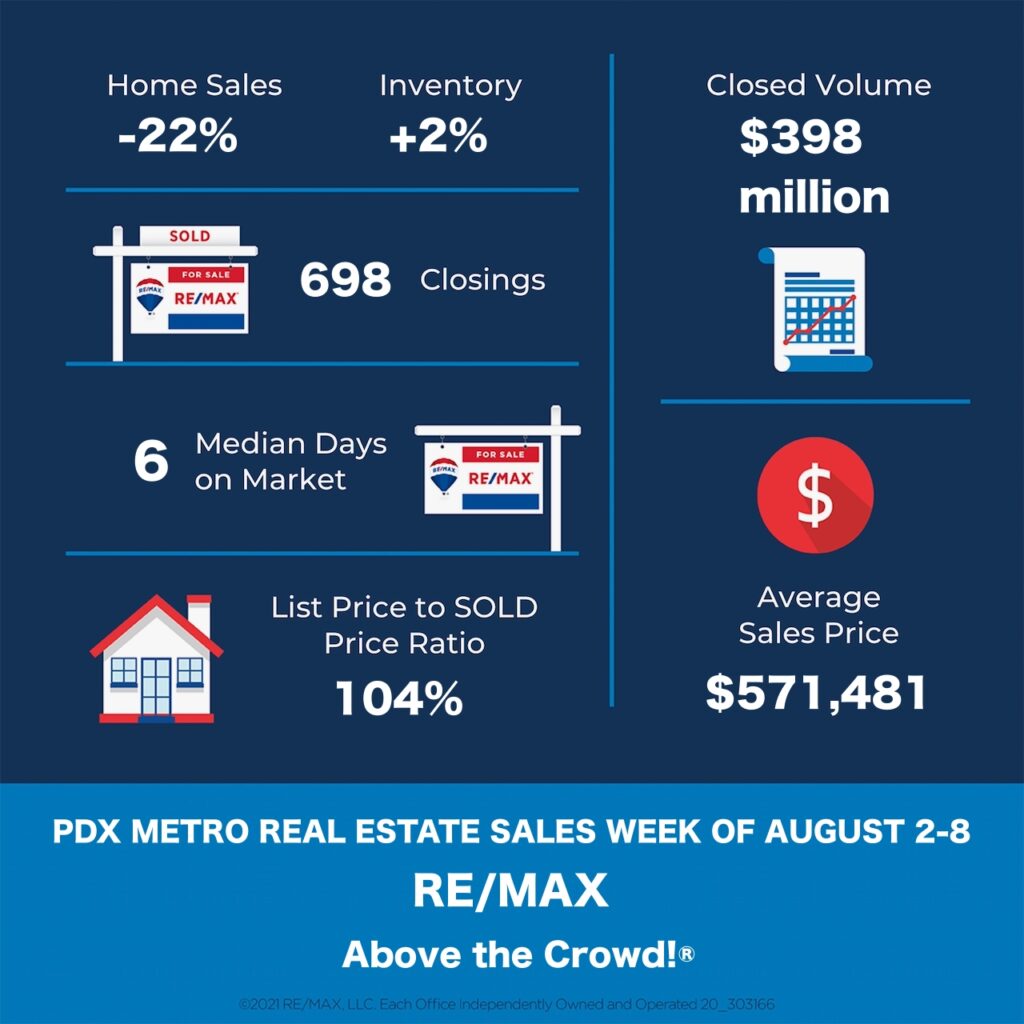

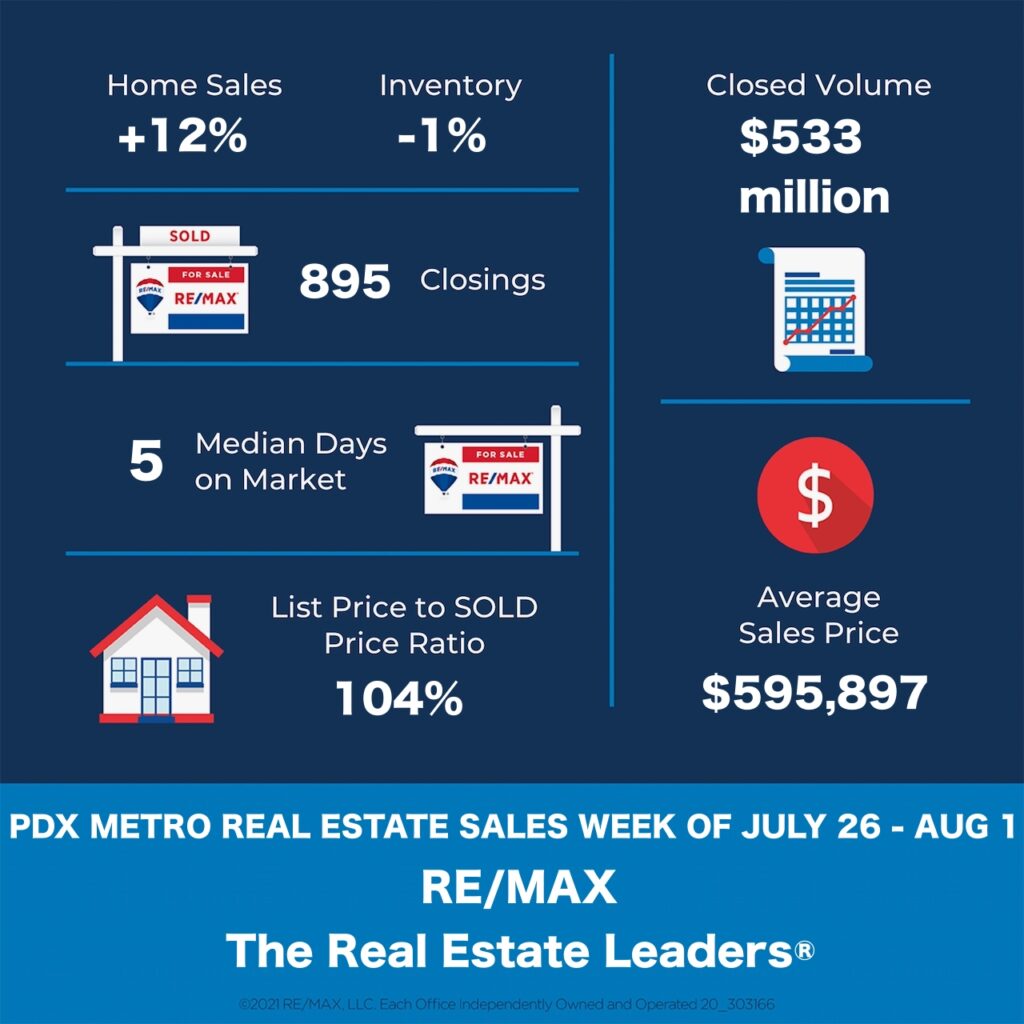

August 3rd

Portland Metro Area (OR and WA)

Market Activity for the Week of July 26th through August 1st

Homes Sold: 895 vs previous weeks: 793; 868; 732; 1035; 1035; 917; 802; 737; 685; 896; 792; 807; 749; 848; 684; 733; 687; 687; and 581. During the same week last year, this number was 1042.

Active Listings: 3427 vs previous weeks: 3446; 3278; 3209; 3425; 3091; 2967; 2822; 2744; 2568; 2593; 2476; 2289; 2265; 2173; 2275 2252; 2163; 2135; and 1998.

Total number of Pending Deals: 6195 vs vs previous weeks: 6244; 6256; 6250; 6186; 6586; 6593; 6664; 6546; 6587; 6640; 6561; 6501; 6388; 6393; 6216; 6049; 5894; 5835 and 5779.

New Pending Deals: 1074 vs previous weeks: 1049; 1101; 836; 934; 1030; 1050; 1068; 904; 1084; 1117; 1079; 998; 1037; 1088; 952; and 894.

Average Days on Market: 17 (35 last year)

Median Days on Market: 5 (11 last year).

Average Sale Price: $595,897 vs $511,094 during the same week last year.

Total Sales Volume: $533,327,815 vs $532,559,948 during the same week last year.

Average List Price vs Sale Price:

Average Sale Price as a Percentage of the Asking Price – 102.93%

Median Sale Price as a Percentage of the Asking Price – 104.21%

Average Sale Price as a Percentage of the Original Asking Price – 102.15%

One of the biggest misconceptions of home buying? The 20% down payment. Here’s how to buy with a lot less down.

From HomeLogic

Buying your first home conjures up all kinds of warm and fuzzy emotions: pride, joy, contentment. But before you get to the good stuff, you’ve got to cobble together a down payment, a daunting sum if you follow the textbook advice to squirrel away 20% of a home’s cost.

Here are five creative ways to build your down-payment nest egg faster than you may have ever imagined.

You may have heard of people using sites like Kickstarter to fund creative projects like short films and concert tours. Well, who says you can’t crowdsource your first home? Forget the traditional registry, the fine china, and the 16-speed blender. Use sites like Feather the Nest and Hatch My House to raise your down payment. Hatch My House says it’s helped Americans raise more than $2 million for down payments.

When sellers want to a get a deal done quickly, they might be willing to assist buyers with the closing costs. Fewer closing costs = more money you can apply toward your deposit.

“They’re called seller concessions,” says Ray Rodriguez, regional mortgage sales manager for the New York metro area at TD Bank. Talk with your real estate agent. She might help you negotiate for something like 2% of the overall sales price in concessions to help with the closing costs.

There are limits on concessions depending on the type of mortgage you get. For FHA mortgages, the cap is 6% of the sale price. For Fannie Mae-guaranteed loans, the caps vary between 3% and 9%, depending on the ratio between how much you put down and the amount you finance. Individual banks have varying caps on concessions. No matter where they net out, concessions must be part of the purchase contract.

The U.S. Department of Housing and Urban Development, or HUD, offers a number of homeownership programs, including assistance with down payment and closing costs. These are typically available for people who meet particular income or location requirements. HUD has a list of links by state that direct you to the appropriate page for information about your state.

HUD offers help based on profession as well. If you’re a law enforcement officer, firefighter, teacher, or EMT, you may be eligible under its Good Neighbor Next Door Sales Program for a 50% discount on a house’s HUD-appraised value in “revitalization areas.” Those areas are designated by Congress for homeownership opportunities. And if you qualify for an FHA-insured mortgage under this program, the down payment is only $100; you can even finance the closing costs.

For veterans, the VA will guarantee part of a home loan through commercial lenders. Often, there’s no down payment or private mortgage insurance required, and the program helps borrowers secure a competitive interest rate.

Some cities also offer homeownership help. “The city of Hartford has the HouseHartford Program that gives down payment assistance and closing cost assistance,” says Matthew Carbray, a certified financial planner with Ridgeline Financial Partners and Carbray Staunton Financial Planners in Avon, Conn. The program partners with lenders, real estate attorneys, and homebuyer counseling agencies and has helped 1,200 low-income families.

Employer Assisted Housing (EAH) programs help connect low- to moderate-income workers with down payment assistance through their employer. In Pennsylvania, if you work for a participating EAH employer, you can apply for a loan of up to $8,000 for down payment and closing cost assistance. The loan is interest-free and borrowers have 10 years to pay it back.

Washington University in St. Louis offers forgivable loans to qualified employees who want to purchase housing in specific city neighborhoods. University employees receive the lesser of 5% of the purchase price or $6,000 toward down payment or closing costs.

Ask the human resources or benefits personnel at your employer if the company is part of an EAH program.

Finally, many lenders offer programs to help people buy a home with a small down payment. “I would say that the biggest misconception [of homebuying] is that you need 20% for the down payment of a house,” says Rodriguez. “There are a lot of programs out there that need a total of 3% or 3.5% down.”

FHA mortgages, for example, can require as little as 3.5%. But bear in mind that there are both upfront and monthly mortgage insurance payments. “The mortgage insurance could add another $300 to your monthly mortgage payment,” Rodriguez says.

Some lender programs go even further. TD Bank, for example, offers a 3% down payment with no mortgage insurance program, and other banks may have similar offerings. “Check with your regional bank,” Rodriguez says. “Maybe they have their own first-time buyer program.”

Not so daunting after all, is it? There’s actually a lot of help available to many first-time buyers who want to achieve their homeownership dreams. All you need to do is a little research — and start peeking at those home listings!