At 12:01am today, most of the state’s COVID restrictions were lifted pursuant to the Governor’s latest executive order. This includes the lifting of the statewide mask mandate, capacity limitations for businesses and other venues, and physical distancing requirements. Masks will still be required in some settings such as public transit and certain health care settings. The Oregon Health Authority will be taking down much of its guidance and replacing it with best practices.

Local jurisdictions and businesses may continue to operate with their own health and safety policies in place and everyone is encouraged to continue to follow guidance from the CDC on slowing the spread of COVID-19 which includes mask wearing for unvaccinated individuals.

Planning to Paint This Summer? Make Sure To Do These Things First

What Do Experts See on the Horizon for the Second Half of the Year?

As we move into the latter half of the year, questions about what’s to come are top of mind for buyers and sellers. Near record-low mortgage rates coupled with rising home price appreciation kicked off a robust housing market in the first half of 2021, but what does the forecast tell us about what’s on the horizon?

Mortgage Rates Will Likely Increase, but Remain Low

Many experts are projecting a rise in interest rates. The latest Quarterly Forecast from Freddie Mac states:

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

However, even as mortgage rates rise, the anticipated increase is expected to be modest at most, and still well below historical averages. Rates remaining low is good news for homebuyers who are looking to maximize their purchasing power. The same report from Freddie Mac goes on to say:

“While higher mortgage rates will help slow the pace of home sales and moderate house price growth, we expect overall housing market activity will remain robust. Our forecast has total home sales, the sum of new and existing home sales, at 7.1 million in 2021….”

Home Price Appreciation Will Continue, but Price Growth Will Likely Slow

Joe Seydl, Senior Markets Economist at J.P. Morgan, projects home prices to continue rising as well, indicating buyers interested in purchasing a home should do so sooner rather than later. Waiting for rates or home prices to fall may not be wise:

“Homebuyers—interest rates are still historically low, though they are inching up. Housing prices have spiked during the last six-to-nine months, but we don’t expect them to fall soon, and we believe they are more likely to keep rising. If you are looking to purchase a new home, conditions now may be better than 12 months hence.”

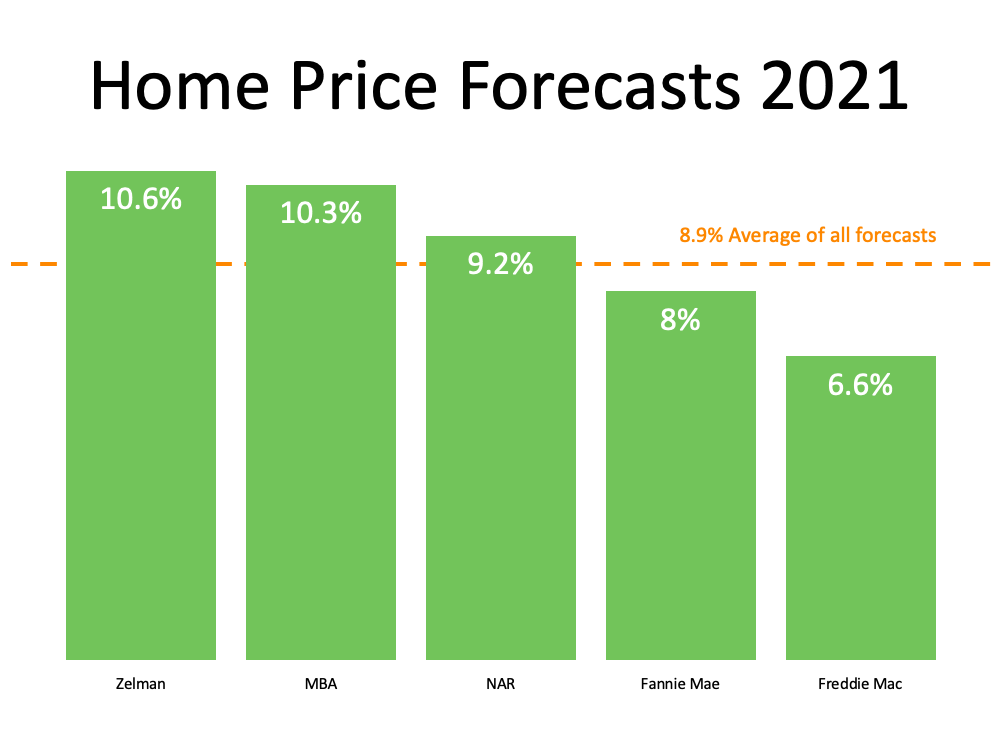

Other experts remain optimistic about home prices, too. The graph below highlights 2021 home price forecasts from multiple industry leaders:

Inventory Remains a Challenge, but There’s Reason To Be Optimistic

Home prices are rising, but they should moderate as more housing inventory comes to market. George Ratiu, Senior Economist at realtor.com, notes there are signs that we may see the current inventory challenges lessen, slowing the fast-paced home price appreciation and creating more choices for buyers:

“We have seen more new listings this year compared with 2020 in 11 of the last 13 weeks. The influx of new sellers over the last couple of months has been especially helpful in slowing price gains.”

New home starts are also showing signs of improvement, which further bolsters hopes of more options coming to market. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), writes:

“As an indicator of the economic impact of housing, there are now 652,000 single-family homes under construction. This is 28% higher than a year ago.”

Finally, while it may not fundamentally change the market conditions we’re currently experiencing, another reason to be optimistic more homes might come to market: our improving economy. Mark Fleming, Chief Economist at First American, notes:

“A growing economy in the summer months has multiple implications for the housing market. Growing consumer confidence, a stronger labor market, and higher wages bode well for housing demand. While a growing economy and improving public health conditions may also spur hesitant existing owners to list their homes for sale, it’s unlikely to significantly ease the super sellers’ market conditions.”

Bottom Line

As we look at the forecast for prices, interest rates, inventory, and home sales, experts remain optimistic about what’s on the horizon for the second half of 2021. Let’s connect today to discuss how we can navigate the market together in the coming months.

What To Expect as Appraisal Gaps Grow

In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

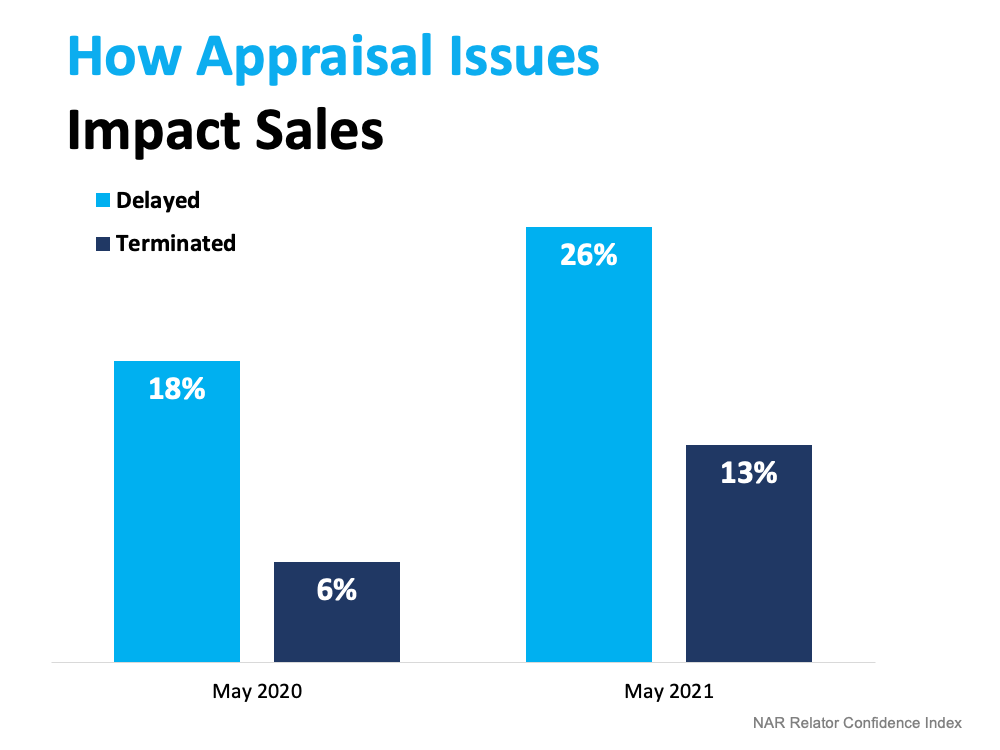

The chart below uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year.If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market.

Bottom Line

Whether you’re buying or selling, let’s connect so you have an ally throughout the process to help you navigate the unexpected, including appraisal gaps.

Homebuyers: Hang in There [INFOGRAPHIC]

![Homebuyers: Hang in There [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/06/24105823/20210625-MEM-1046x2093.png)

Some Highlights

- Today’s sellers’ market provides unique challenges—and benefits—for buyers.

- Current low interest rates won’t last forever, and home prices are forecast to rise.

- If you’re a homebuyer, hang in there. Homeownership improves your quality of life, and the long-term benefits outweigh the short-term challenges.

Homeowner Wealth Increases Through Growing Equity This Year

Building financial wealth and stability remains one of the top reasons Americans choose to own a home, and as a homeowner, your wealth often grows without you even realizing it. In a recent paper published by the Urban Institute, Home Ownership is Affordable Housing, author Mike Loftin illustrates how homeowners increase their equity and their wealth simply by making monthly mortgage payments:

“The principal portion that reduces the loan balance builds the homeowner’s equity. In doing so, the principal payments behave like an automatic savings account. The principal payment is not money going out; it is money staying in.”

But home equity – the difference between the value of your home and what you currently owe – isn’t just built through your monthly principal payments. Home price appreciation plays a vital role in growing your equity and, ultimately, your wealth.

As Freddie Mac explains:

“Homeownership has cemented its role as part of the American Dream, providing families with a place that is their own and an avenue for building wealth over time. This ‘wealth’ is built, in large part, through the creation of equity…Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

Homeowners Continue To See Equity Increase

CoreLogic recently published their latest Homeowner Equity Insights Report, and it shows continued growth in equity amidst record home price appreciation. The report provides several key takeaways, all of which point to rising wealth for homeowners:

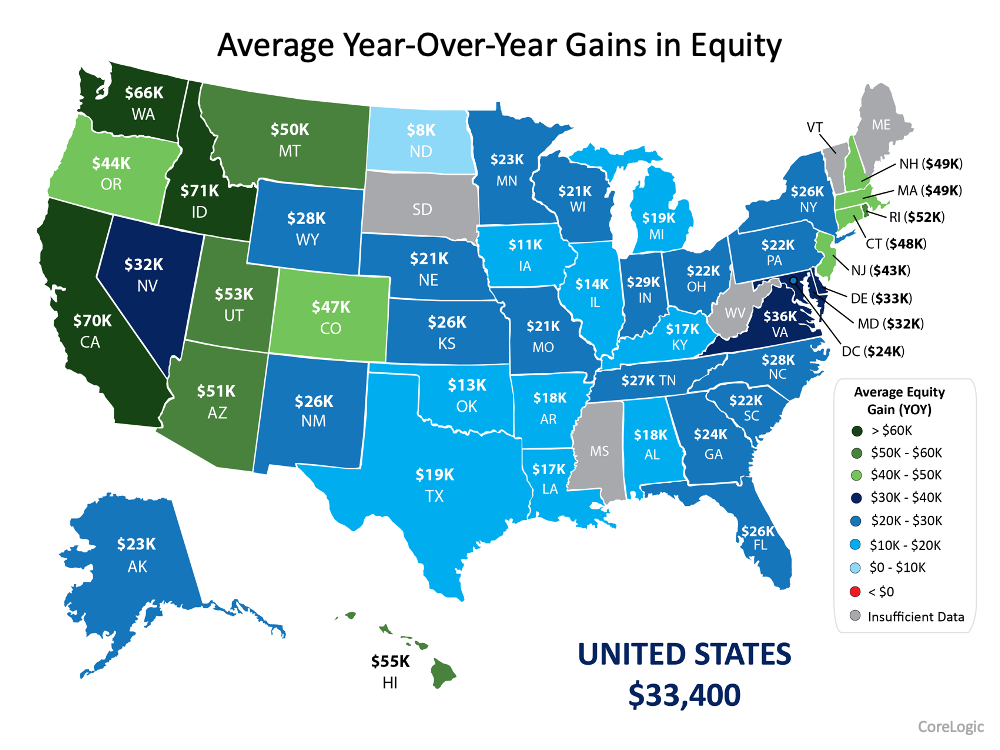

- The average equity gain of mortgaged homes during the past year was $33,400

- The current average equity of mortgaged homes is greater than $216,000

- There was a 6% increase in total homeowner equity over the past year

- Total U.S. homeowner equity has reached nearly $1.9 trillion

Here, you can see the equity gains by state:

Equity Provides Homeowners with Flexibility

In addition to being a critical tool in building wealth, a homeowner’s equity also provides significant flexibility. When you sell your house, the accumulated equity comes back to you in the sale. Recent increases in home equity coupled with record-low mortgage rates mean it could be the perfect time for homeowners looking to make a move.

Mark Fleming, Chief Economist at First American, notes:

“Existing homeowners today are sitting on record amounts of equity. As homeowners gain equity in their homes, the temptation grows to list their current home for sale and use the equity to purchase a larger or more attractive home.”

Increasing equity also helps families facing challenges brought on by the pandemic. Frank Martell, President and CEO of CoreLogic, explains in the recent Homeowner Equity Insights Report:

“Homeowner equity has more than doubled over the past decade and become a crucial buffer for many weathering the challenges of the pandemic. These gains have become an important financial tool and boosted consumer confidence in the U.S. housing market, especially for older homeowners and baby boomers who’ve experienced years of price appreciation.”

Bottom Line

Home equity has always been a powerful wealth-building tool, and homeowners continue to see their financial stability increase. Let’s connect today so you can better understand how much equity you have in your current home or if you’re ready to take the next step in building your savings as a homeowner.

Pre-Approval Makes All the Difference When Buying a Home

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Especially in today’s market, with rising home prices and high buyer competition, it’s crucial to have a clear understanding of your budget so you stand out to sellers as a serious homebuyer.

Being intentional and competitive are musts when buying a home right now. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Just as important, being able to present a pre-approval letter shows sellers you’re a qualified buyer, something that can really help you land your dream home in an ultra-competitive market.

With limited housing inventory, there are many more buyers active in the market than there are sellers, and that’s creating some serious competition. According to the National Association of Realtors (NAR), homes are receiving an average of 5.1 offers for sellers to consider. As a result, bidding wars are more and more common. Pre-approval gives you an advantage if you get into a multiple-offer scenario, and these days, it’s likely you will. When a seller knows you’re qualified to buy the home, you’re in a better position to potentially win the bidding war.

Freddie Mac explains:

“By having a pre-approval letter from your lender, you’re telling the seller that you’re a serious buyer, and you’ve been pre-approved for a mortgage by your lender for a specific dollar amount. In a true bidding war, your offer will likely get dropped if you don’t already have one.”

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing. Interest rates are low, prices are going up, and lending institutions are regularly updating their standards. You’re going to need guidance to navigate these waters, so it’s important to have a team of professionals such as a loan officer and a trusted real estate agent making sure you take the right steps and can show your qualifications as a buyer when you find a home to purchase.

Bottom Line

In a competitive market with low inventory, a pre-approval letter is a game-changing piece of the homebuying process. Not only does being pre-approved bring clarity to your homebuying budget, but it shows sellers how serious you are about purchasing a home.

5 Things Homebuyers Need To Know When Making an Offer

When it comes to buying a house, you’re looking for the perfect place to call home. The problem is, in today’s market there just aren’t that many homes available to purchase. With inventory hovering near record lows and sky-high buyer demand, a multi-offer scenario is the new normal. Here are five things to keep in mind when you’re ready to make an offer.

1. Know Your Numbers

Having a complete understanding of your budget and how much house you can afford is essential. That’s why you should connect with a lender to get pre-approved for a loan early in the homebuying process. Taking this step shows sellers you’re a serious, qualified buyer and can give you a competitive edge in a bidding war.

2. Brace for a Fast Pace

Today’s market is dynamic and fast-paced. According to the Realtors Confidence Index from the National Association of Realtors (NAR), the average home is on the market for just 17 days – that means from start to finish, a house for sale in today’s climate is active for roughly 2.5 weeks. A skilled agent will do everything they can to help you stay on top of every possible opportunity. And, as soon as you find the right home for your needs, that agent will help you draft and submit your best offer as quickly as possible.

3. Lean on a Real Estate Professional

While homebuying may seem like a whirlwind process to you, local real estate agents do this every day, and we know what works. That expertise can be used to give you a significant leg up on your competition. An agent can help you consider what levers you can pull that might be enticing to a seller, like:

- Offering flexible rent-back options to give the seller more time to move out

- Your ability to do a quick close or make an offer that’s not contingent on the sale of your current home

It may seem simple, but catering to what a seller may need can help your offer stand out.

4. Make a Strong, but Fair Offer

Let’s face it – we all love a good deal. In the past, offering at or near the asking price was enough to make your offer appealing to sellers. In today’s market, that’s often not the case. According to Lawrence Yun, Chief Economist at NAR:

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

In such a competitive market, emotions and prices can run high. Use an agent as your trusted advisor to make a strong, but fair offer based on market value, recent sales, and demand.

5. Be a Flexible Negotiator

If you followed tip #3, you drafted the offer with the seller’s needs in mind. That said, the seller may still counter with their own changes. Be prepared to amend your offer to include flexible move-in dates, a higher price, or minimal contingencies (conditions you set that the seller must meet for the purchase to be finalized). Just remember, there are certain contingencies you don’t want to forego. Freddie Macexplains:

“Resist the temptation to waive the inspection contingency, especially in a hot market or if the home is being sold ‘as-is’, which means the seller won’t pay for repairs. Without an inspection contingency, you could be stuck with a contract on a house you can’t afford to fix.”

Bottom Line

When it’s time to make an offer, it’s important to consider not just what you need, but what the seller may need too. Let’s connect so you have expert advice on this step in the homebuying process to put your best offer on the table.

The Right Expert Will Guide You Through This Unprecedented Market

In a normal market, it’s good to have an experienced guide coaching you through the process of buying or selling a home. That person can advise you on important things like pricing your home correctly or the first steps to take when you’re ready to buy. However, the market we’re in today is far from normal. As a result, an expert isn’t just good to have by your side – an expert is essential.

Today’s housing market is full of extremes. Mortgage rates hovering near record-lows are driving high buyer demand. On the other hand, an absence of sellers is creating record-low housing inventory. This imbalance in supply and demand is leading to a skyrocketing rate of bidding wars and more houses selling over their asking price. This is driving home price appreciation and gains in home equity. These market conditions aren’t just extreme – they can be overwhelming. Having a trusted expert to coach you through the process of buying and selling a home gives you clarity, confidence, and success through each step.

Here are just a few of the ways a real estate expert is invaluable:

- Contracts – We help with the disclosures and contracts necessary in today’s heavily regulated environment.

- Experience – We’re well-versed in real estate and experienced with the entire sales process, including how it’s changed over the past year.

- Negotiations – We act as a buffer in negotiations with all parties throughout the entire transaction while advocating for your best interests.

- Education – We simply and effectively explain today’s market conditions and decipher what they mean for your individual goals.

- Pricing – We help you understand today’s real estate values when setting the price of your home or making an offer to purchase one.

A real estate agent can be your essential guide through this unprecedented market, but truth be told, not all agents are created equal. A true expert can carefully walk you through the whole real estate process, look out for your unique needs, and advise you on the best ways to achieve success. Finding the right agent should be your top priority when you’re ready to buy or sell a home.

So, how do you choose the right expert?

It starts with trust. You’ll have to be able to trust the advice your agent is going to give you, so make sure you’re connected to a true professional. An agent can’t give you perfect advice because it’s impossible to know exactly what’s going to happen at every turn – especially in this unique market. A true professional expert can, however, give you the best possible advice based on the information and situation at hand, helping you make the necessary adjustments and best decisions along the way. The right agent – the professional – will help you plan the steps to take for success, advocate for you throughout the process, and coach you on the essential knowledge you need to make confident decisions toward your goals. That’s exactly what you want and deserve.

Bottom Line

It’s crucial right now to work with a real estate expert who understands how the market is changing and what that means for home buyers and sellers. If you’re planning to make a move this year, let’s connect so you have someone who can answer your questions, give you the best advice, and guide you along the way.

Owning a Home Has Distinct Financial Benefits Over Renting [INFOGRAPHIC]

![Owning a Home Has Distinct Financial Benefits Over Renting [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/06/16121610/20210518-MEM-1046x2442.png)

Some Highlights

- When you rent, you build your landlord’s wealth, your monthly payment depends on ever-rising rents, and you don’t benefit from home price appreciation.

- On the other hand, when you own your home, you build your own wealth, your monthly payment is locked in, and you benefit directly from home price appreciation.

- If you’re feeling the challenges of a competitive market, remember that homeownership is a long-term game. Persevering today will lead to financial rewards in the future.