November 17, 2020 Media Contact: Quintin Simmons 202-383-1178

Source: NAR

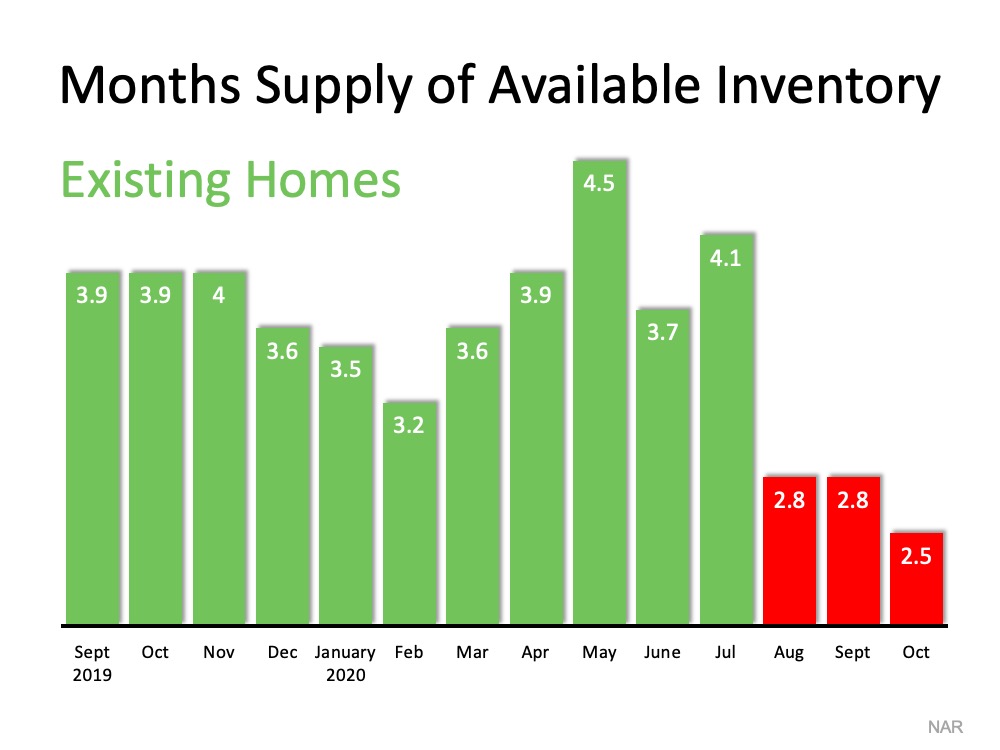

WASHINGTON (November 17, 2020) – The housing industry has exceeded expectations for 2020 and the marketplace will continue to see home price and sales growth in the coming year, National Association of Realtors® Chief Economist Lawrence Yun said at the 2020 REALTORS® Conference & Expo(link is external).

“The housing market has been exceptional in 2020, with demand soaring alongside low interest rates and a shift toward remote work for a good number of the labor force,” Yun told attendees of the Residential Economic Issues & Trends Forum on Tuesday.

Home sales set a number of records this year despite – and in some cases, because of – the coronavirus pandemic. Yun, who is also senior vice president of research at NAR, commented on record-setting home price growth occurring across much of the country.

“The consequent rise in home prices has boosted wealth accumulation for homeowners,” Yun said. “But the opposite side of this will mean the continued decline of housing affordability and will limit future homeownership opportunities for young adults if housing supply is not greatly increased.”

While U.S. gross domestic product is down as a result of the COVID-19 outbreak, Yun noted that overall incomes have received a boost from federal stimulus issued earlier this year. Additionally, some households saw a net increase in their savings while much of the country was under stay-at-home orders and consumer spending dropped. Yun projected Tuesday that this increase in collective savings will ultimately stimulate the economy once a coronavirus vaccine is created and distributed.

Yun is forecasting 20% total growth in new home sales in 2020 alongside a 3% overall increase in existing-home sales. Anticipating the favorable climate will bleed into next year, Yun expects new home sales to jump 21% and existing-home sales to climb at least 9% in 2021. “The second-order housing demand arising from remote work flexibility and changing housing preference will continue next year,” he noted.

Mortgage rates are likely to see a 3.0% gain by the end of the year, and a 3.1% jump in 2021. By the end of 2020, home prices will have risen by 6%, with an additional 3% of growth expected in 2021, Yun said.

As the nation prepares for a new president to take office next year, Yun dissected housing proposals already put forth by the likely President-elect Joe Biden.

“The Biden Presidency could bring several impactful changes to the housing market,” Yun said. “The homebuyer tax credit he proposed as a candidate would help Americans cover their down payment costs and is likely firmer assurance of government guarantees to mortgages backed by Fannie Mae and Freddie Mac.

“In addition, new appointees at the Federal Reserve are likely to pursue an expansionary monetary policy for a longer period, which should keep interest rates stable over the next few years,” he said. “However, the much-needed increase in supply could be hampered by a removal of the 1031-exchange, which facilitates land sales for homebuilding.”

The National Association of Realtors® is America’s largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries.

# # #

![Tips to Sell Your House Safely Right Now [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2020/11/12090934/20201113-MEM-1046x1641.png)