Nearly Half of Buyers Cite Bidding Wars as Biggest Hurdle on the Path to Homeownership

Have Your Day in the Sun by Moving Up This Summer [INFOGRAPHIC]

![Have Your Day in the Sun by Moving Up This Summer [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/06/10133027/20210611-MEM-1046x1956.png)

Some Highlights

- Longer days and sunny weather mean summer is upon us, and what better conditions than right now to upgrade to the home of your dreams?

- If your needs have changed, it’s a great time to upgrade – there’s likely high demand for your current house, and today’s low mortgage rates can help you afford your dream home.

- If you’re ready to upgrade to a home that matches your changing needs, let’s connect today.

Why This Is Not Like 2008 Again

During the Great Recession, just over a decade ago, the financial systems the world depended on started to collapse. It created a panic that drove some large companies out of business (ex. Lehman Brothers) and many more into bankruptcy.

The financial crisis that accompanied the current pandemic caused hardship to certain industries and hurt many small businesses. However, it hasn’t rattled the world economy. It seems that a year later, things are slowly getting back to normal for many companies.

Why is there a drastic difference between 2008 and now?

In a post from RealtyTrac, they explain:

“We changed the rules. We told banks they needed more reserves and that they could no longer underwrite toxic mortgages. It turns out that regulation — properly done — can help us navigate financial minefields.”

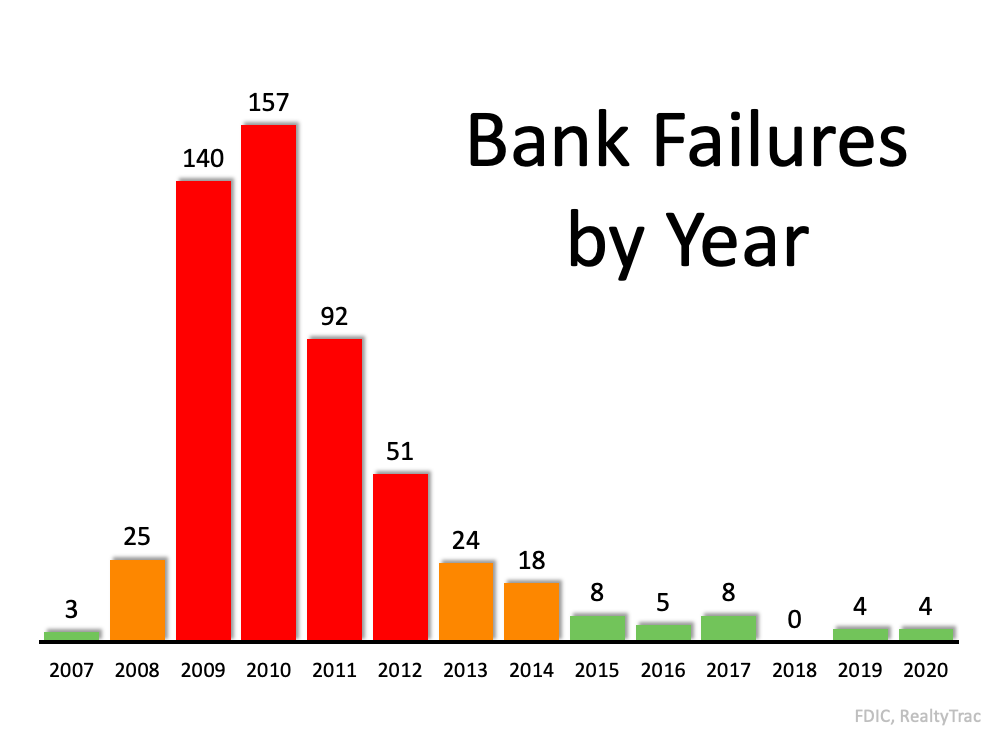

Here are the results of that regulation, captured in a graph depicting the number of failed banks since 2007.

What was different this time?

The post mentioned above explains:

“In 2008 the government saw the foreclosure meltdown as a top-down problem and set aside $700 billion for banks under the Troubled Asset Relief Program (TARP). Not all of the $700 billion was used, but the important point is that the government did not act with equal fervor to help flailing homeowners, millions of whom lost their homes to foreclosures and short sales.

This time around the government forcefully moved to help ordinary citizens. Working from the bottom-up, an estimated $5.3 trillion went to the public in 2020 through such mechanisms as the Paycheck Protection Program (PPP), expanded unemployment benefits, tax incentives, and help for local governments. So far this year we have the $1.9 billion American Rescue Plan with millions of $1,400 checks as well as proposals to spend trillions more on infrastructure…Bank deposits increased by nearly $2 trillion during the past year and credit card debt fell.”

Bottom Line

Many have suffered over the past year. However, the economic toll of the current recession was nowhere near the scope of the Great Recession, and it won’t result in a housing crisis.

Home Price Appreciation Is as Simple as Supply and Demand

Home price appreciation continues to accelerate. Today, prices are driven by the simple concept of supply and demand. Pricing of any item is determined by how many items are available compared to how many people want to buy that item. As a result, the strong year-over-year home price appreciation is simple to explain. The demand for housing is up while the supply of homes for sale hovers at historic lows.

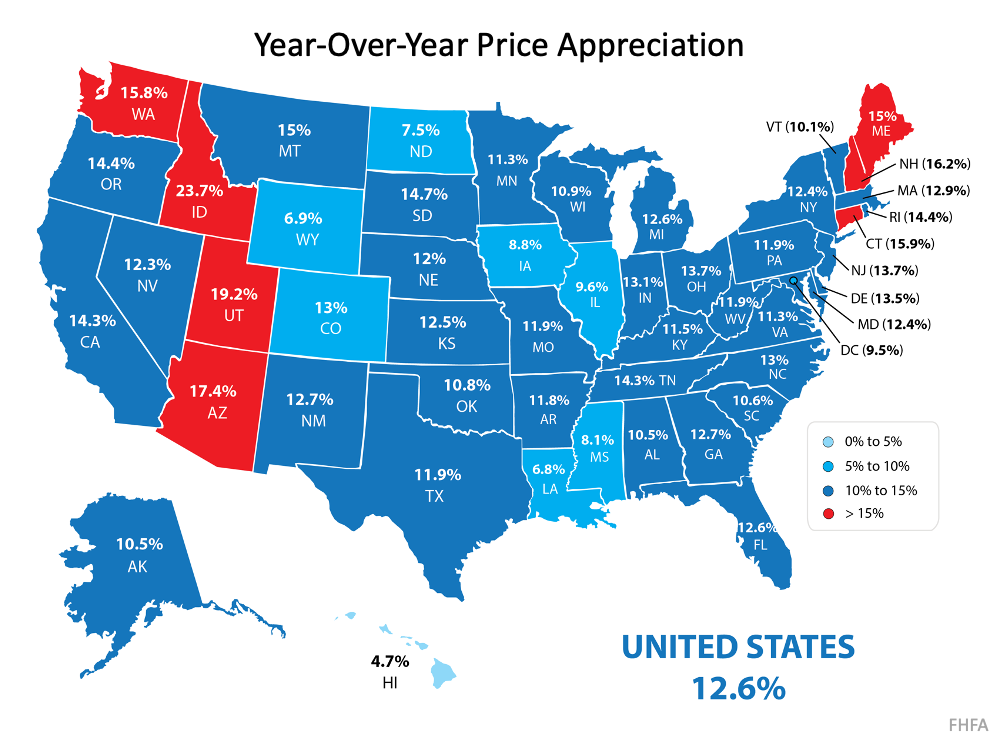

Let’s use three maps to show how this theory continues to affect the residential real estate market.

Map #1 – State-by-state price appreciation reported by the Federal Housing Finance Agency (FHFA) for the first quarter of 2021 compared to the first quarter of 2020:As the map shows, certain states (colored in red) have appreciated well above the national average of 12.6%.

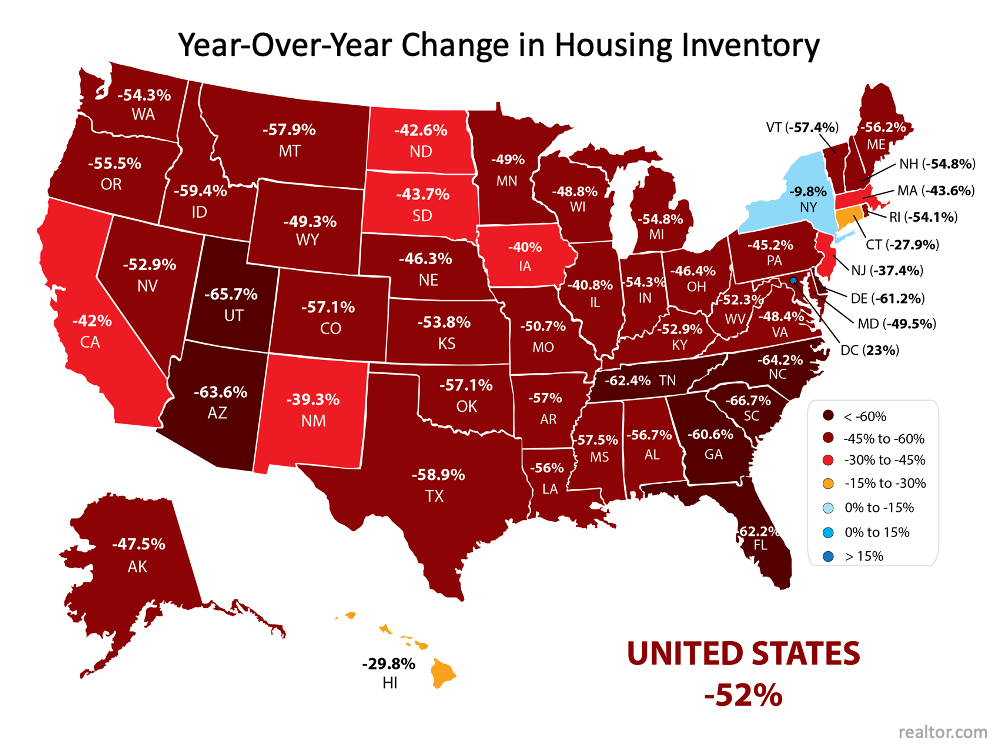

Map #2 – The change in state-by-state inventory levels year-over-year reported by realtor.com:Comparing the two maps shows a correlation between change in listing inventory and price appreciation in many states. The best examples are Idaho, Utah, and Arizona. Though the correlation is not as easy to see in every state, the overall picture is one of causation.

The reason prices continue to accelerate is that housing inventory is still at all-time lows while demand remains high. However, this may be changing.

Is there relief around the corner?

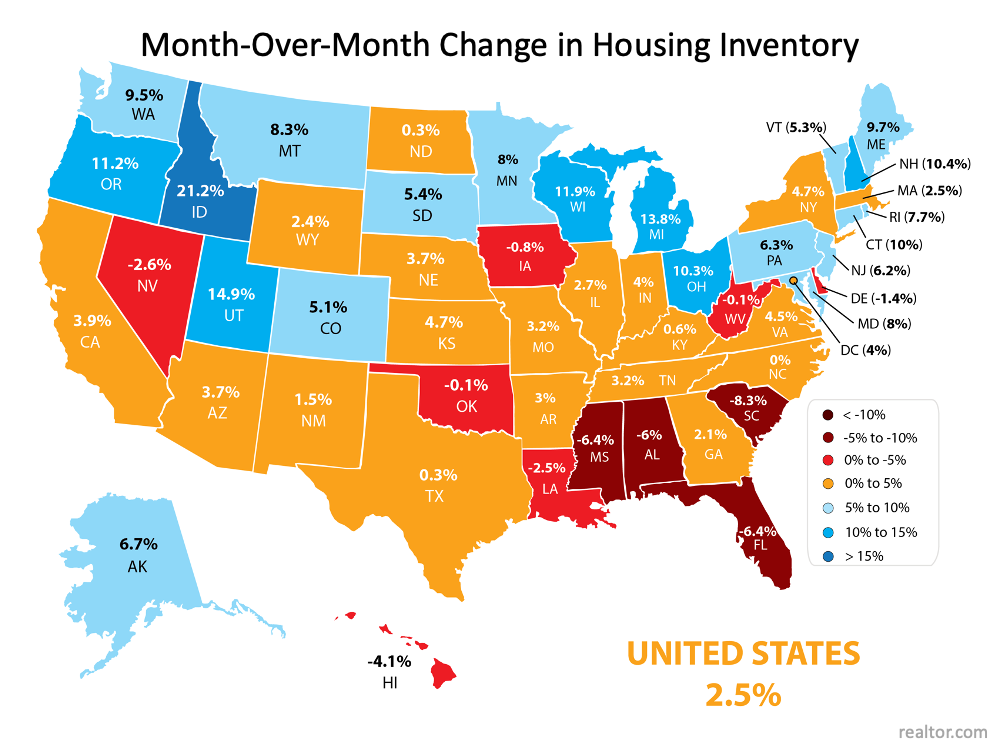

The report by realtor.com also shows the monthly change in inventory for each state.

Map #3 – State-by-state changes in inventory levels month-over-month reported by realtor.com:As the map indicates, 39 of the 50 states (plus the District of Columbia) saw increases in inventory over the last month. This may be evidence that homeowners who have been afraid to let buyers in their homes during the pandemic are now putting their houses on the market.

We’ll know for certain as we move through the rest of the year.

Bottom Line

Some are concerned by the rapid price appreciation we’ve experienced over the last year. The maps above show that the increases were warranted based on great demand and limited supply. Going forward, if the number of homes for sale better aligns with demand, price appreciation will moderate to more historical levels.

In Today’s Market, Listing Prices Are Like an Auction’s Reserve Price

For generations, the process of buying and selling a home never really changed. A homeowner would try to estimate the market value of their house, then tack on a little extra to give themselves some negotiating room. That figure would become the listing price. Buyers would then try to determine how much less than the full price they could offer and still get the home. As a result, the listing price was generally the ceiling of the negotiation. The actual sales price would almost always be somewhat lower than what was listed. It was unthinkable to pay more than what the seller was asking.

Today is different.

The record-low supply of homes for sale coupled with very strong buyer demand is leading to a rise in bidding wars on many homes. Because of this, homes today often sell for more than the list price. In some cases, they sell for a lot more.

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“For every listing there are 5.1 offers. Half of the homes are being sold above list price.”

You may need to change the way you look at the asking price of a home.

In this market, you likely can’t shop for a home with the former approach of negotiating to a lower price.

Due to the low supply of houses for sale, many homes are now being offered in an auction-like atmosphere in which the highest bidder wins the home. In an actual auction, the seller of an item agrees to take the highest bid, and many sellers set a reserve price on the item they’re selling. A reserve price is the minimum amount a seller will accept as the winning bid.

When navigating a competitive housing market, think of the list price of the house as the reserve price at an auction. It’s the minimum the seller will accept in many cases. Today, the asking price is often becoming the floor of the negotiation rather than the ceiling. Therefore, if you really love a home, know that it may ultimately sell for more than the sellers are asking. So, as you’re navigating the homebuying process, make sure you know your budget, know what you can afford, and work with a trusted advisor who can help you make all the right moves as you buy a home.

Bottom Line

Someone who’s more familiar with the housing market of the past than that of today may think it’s foolish to offer more for a home than the listing price. However, frequent and competitive bidding wars are creating an auction-like atmosphere in many real estate transactions right now. Let’s connect today so you have a trusted real estate professional on your side to provide the best advice on how to make a competitive offer on a home.

Top Reasons To Own Your Home [INFOGRAPHIC]

![Top Reasons To Own Your Home [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/06/03101649/20210604-MEM-1046x2206.png)

Some Highlights

- June is National Homeownership Month, and it’s a great time to consider the benefits of owning your own home.

- If you’re thinking of buying a home, it might just help you find the stability, community, and comfort you’ve been searching for over the past year.

- Let’s connect today to determine if homeownership is the right next step for you.

Dreaming of a Bigger Home? Why Not Buy It This Year?

Are you clamoring for extra rooms or a more functional floorplan in your house? Maybe it’s time to make a move. If you’ll be able to work remotely for the long-term or your overall needs have simply changed, it’s a great time to sell your house and move up. Why? With mortgage rates in their favor and higher-priced home sales powering more moves across the country, sellers in today’s market are finding the space they need (and have always dreamed of) by purchasing a home in the upper end of the housing market.

With so few homes available for sale and high demand from today’s homebuyers, sellers are profiting in major ways this season. Bidding wars are gaining traction, driving up the sale price of more and more homes throughout the country. This means sellers are able to leverage extra cash from higher-priced sales while also taking advantage of today’s low mortgage rates when they purchase their next home. It’s the perfect scenario to move up into a true dream home. According to the April Luxury Market Report from the Institute for Luxury Home Marketing:

“The Institute’s recent analysis of sales in 2020 for homes over 5,000 square feet support the continuing preference for larger homes. The analysis determined that there was a 17% increase in the number of 5,000+ sq ft homes sold when compared to the number of sales in 2019.

Luxury home prices continue to see record highs in the majority of affluent ex-urban communities, as the influence of being able to work from home is still driving buyers away from living in high density areas. Low interest rates also remain in play, allowing buyers to realize the affordability of owning a larger property, which further reinforces this trend.”

Lawrence Yun, Chief Economist for the National Association of Realtors (NAR), also explains:

“The market is hot pretty much everywhere and across all price points . . . The only area where there is sufficient inventory is in $1 million-plus homes . . . .”

While this price range certainly doesn’t fit every budget, if it’s in your reach this summer, you may want to make your move sooner rather than later. Today, more homes are available in this segment of the market, but as the report mentions, more buyers are investing here too, so competition may heat up sooner rather than later.

Bottom Line

If you’re planning to sell your current home to move into a larger one, let’s connect today. We’ll discuss your current situation and the opportunities in our local market.

What’s Motivating People To Move Right Now?

This year, Americans are moving for a variety of reasons. The health crisis has truly reshaped our lifestyles and our needs. Spending so much more time in our current homes has driven many people to reconsider what homeownership means and what they find most valuable in their living spaces.

According to the 2020 Annual National Movers Study:

“For customers who cited COVID-19 as an influence on their move in 2020, the top reasons associated with COVID-19 were concerns for personal and family health and wellbeing (60%); desires to be closer to family (59%); 57% moved due to changes in employment status or work arrangement (including the ability to work remotely); and 53% desired a lifestyle change or improvement of quality of life.”

With a new perspective on homeownership, here are some of the reasons people are reconsidering where they live and making moves right now.

1. Working from Home

Remote work became the new norm, and for some, it’s persisting longer than initially expected. Many in the workforce today are discovering they don’t need to live so close to the office anymore and they can get more for their money if they move a little further outside the city limits. Apartment List notes:

“The COVID pandemic has sparked a rebound in residential migration: survey data suggest that 16 percent of American workers moved between April 2020 and April 2021, up from 14 percent in 2019 and the first increase in migration in over a decade… One of the major drivers in this trend is remote work, which expanded greatly in response to COVID and will remain prevalent even after the pandemic wanes. No longer tethered to a physical job site, remote workers were 53 percent more likely to move this past year than on-site workers.”

If you’ve tried to convert your guest room or your dining room into a home office with minimal success, it may be time to find a larger home. The reality is, your current house may not be optimally designed for this kind of space, making remote work very challenging.

2. Room for Fitness & Activities

Staying healthy and active is a top priority for many Americans, and dreams of having space for a home gym are growing stronger. A recent survey of 4,538 active adults from 122 countries noted the three fastest-growing fitness trends amongst active adults:

- At-home fitness equipment (up 50%)

- Personal trainers/nutritionists (up 48%)

- Online fitness courses, classes, and subscriptions (up 17%)

Having room to maintain a healthy lifestyle at home – physically and mentally – may prompt you to consider a new place to live that includes space for at-home workouts, hobbies, and activities for your household.

3. Outdoor Space

Better Homes & Gardens recently released the outdoor living trends for this year, and three of them are:

- Outdoor Kitchens: 60% of homeowners are looking to add outdoor kitchens.

- Edible Garden: Millions of people began gardening during the pandemic . . . to supplement pantries with homegrown fruits, vegetables, and herbs.

- Secluded Spaces: As outdoor activity increases, so does the need for privacy.

You may not, however, currently have the space you need for these designated areas – inside or out.

Bottom Line

If you’re clamoring for more room to accommodate your changing needs, making a move may be your best bet, especially while you can take advantage of today’s low mortgage rates. It’s a great time to get more home for your money, just when you need it most.

Easy DIY Cleaning Tips

Life is messy. But it’s easier than you think to clean up.

Use the sun to bleach your whites

Did you know that the sun can remove some stains? That’s right. The sun naturally bleaches.

Diapers

Wash the diapers and let them dry in direct sunlight for a few hours. Stains will be noticeably lighter or gone.

Grass Stains

Let your grass-stained white dry in the sun to naturally become whiter.

Tomato Stains on Plastic Containers

Set your containers out in the sun and the stains will bleach out.

Remove Ink Stains with Hairspray

Your favorite shirt now has a huge spot where a marker bled on it. Fear not. Find some alcohol-based hairspray. Yes, this works! Spray that tough ink stain with hairspray. Let it dry. Spray it again and wash as usual. The stain will be gone.

Remove Paint Splatter on Clothing with Hand Sanitizer

Get rid of paint stains—even brushes.

Lay the article of clothing flat. Put some hand sanitizer on an old toothbrush and scrub in a circular motion. The paint will loosen and come out. For tougher stains, add a little running alcohol.

Clean Your Drains with Vinegar and Baking Soda

Slow drains? You can help clear them with ingredients you already have in your pantry. Pour a pot of boiling water down your drain. Then put ½ cup of baking soda in the drain.

Pour a mixture of 1 cup vinegar and 1 cup of very hot water down the drain. Let it sit for 5 to 10 minutes and follow with another pot of boiling water.