Last Updated: Aug. 14, 2021 at 2:46 p.m. ETFirst Published: Aug. 12, 2021 at 10:08 a.m. ET By Jacob Passy

Mortgage rates rise for first time in a over a month — as key economic reports shift the market’s outlook – MarketWatch

Home buyers don’t need to fret just yet about rising rates eating into housing affordability, economists say

Mortgage rates surged higher in the wake of July’s strong jobs report as the market begins to price in a change in stance at the Federal Reserve.

The 30-year fixed-rate mortgage averaged 2.87% for the week ending Aug. 11, up 10 basis points from the previous week, Freddie Mac FMCC, -2.55% reported Thursday. It’s the first time in six weeks that the 30-year loan rose on a weekly basis.

The 15-year fixed-rate mortgage increased five basis points to an average of 2.15%, while the 5-year Treasury-indexed hybrid adjustable-rate mortgage ticked up by four basis point to an average of 2.44%.

Mortgage rates rose higher in tandem with rising bond yields, including an increase in the yield on the 10-year Treasury note TMUBMUSD10Y, 1.275%.

“After touching their lowest point in six months, mortgage rates rose over the last seven days as some key economic reports shifted the market’s outlook,” Zillow Z, -0.02% ZG, 0.38% senior economist Matthew Speakman said, adding that the July jobs data released last Friday was the primary impetus for this week’s increase in mortgage rates. Other data also indicated there were a record number of job openings as of June.

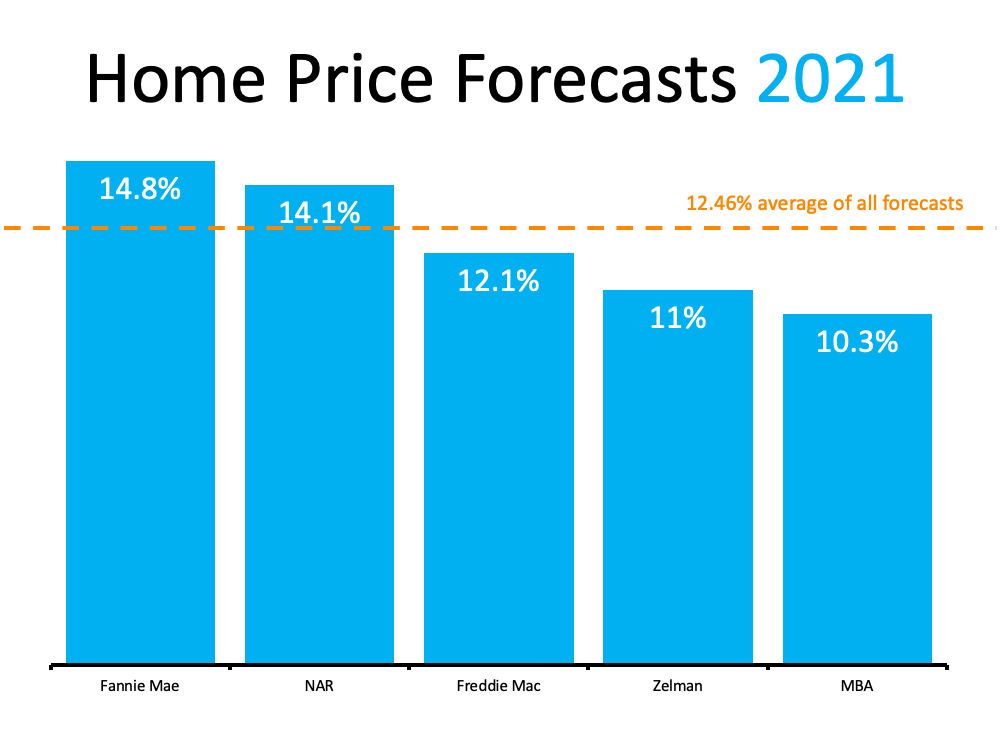

Economists see the positive developments in the labor market, as well as additional indications of rising inflation, as a prelude to the Federal Reserve shifting its stance.

“The Fed has said for months that they will not consider tightening monetary policy until more meaningful progress is achieved in the labor market,” Speakman said. “Indeed, many Fed officials have stated that they view a slowdown in their program of asset purchases to likely be sometime this fall, and the strong jobs figures are giving those statements more weight.”

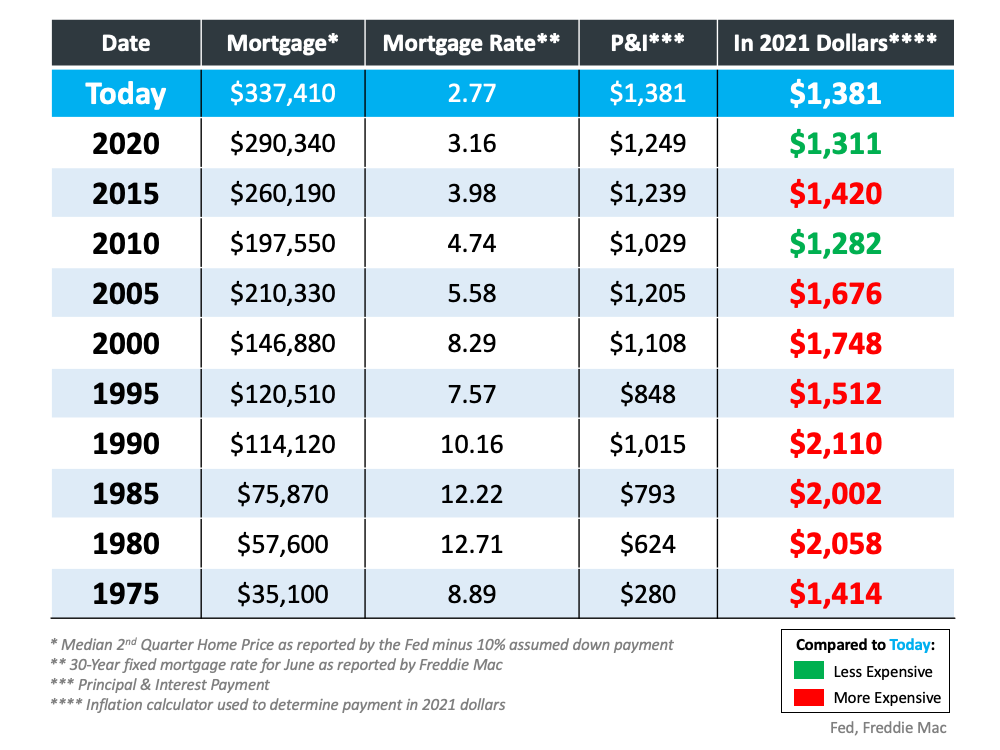

On the home-buying front, while rates may be higher, they are still low from a historical perspective. “Low rates are fueling strong activity into the late-summer season, which historically has seen a slowdown,” said George Ratiu, senior economist at Realtor.com.

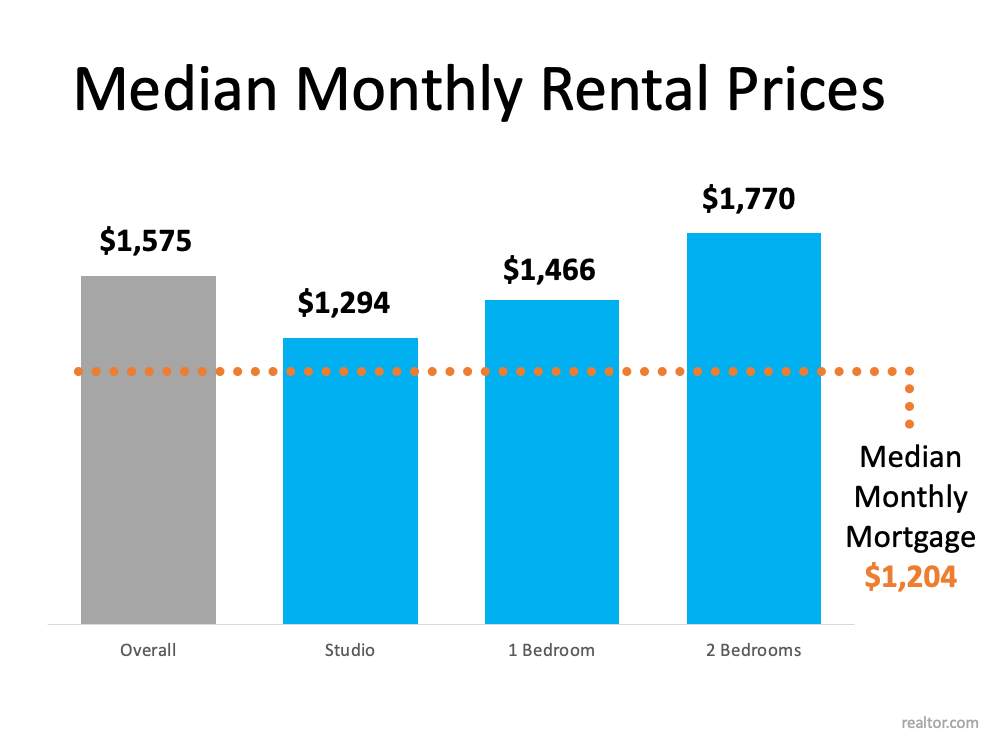

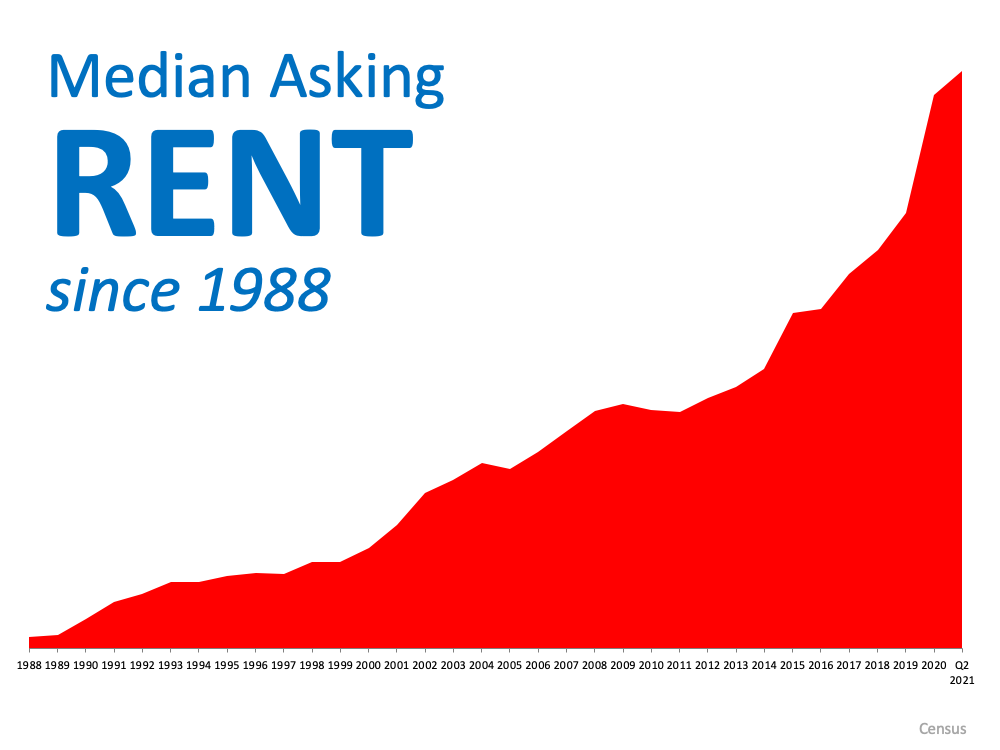

Rising rates won’t necessarily immediately lead to higher costs for home buyers, either. Recent data from Realtor.com shows that the number of new listings of homes for sale continues to grow, which should reduce some of the competition and price pressure buyers were facing due to the inventory shortage playing out nationwide.

(Realtor.com is operated by News Corp NWSA, -3.61% subsidiary Move Inc., and MarketWatch is a unit of Dow Jones, which is also a News Corp subsidiary.)

“These factors also signal that fall may turn out to be a busier season than usual, as buyers seek to take advantage of improving market conditions,” Ratiu said.

![Sellers Are in a Sweet Spot [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2021/08/12132433/20210806-MEM-1-1046x2364.png)