Cooking, caroling, and…closing on a new home? Real estate pros share what buyers can expect from the process – and the current market – when purchasing a new place before 2023.

From traveling to gathering with family to hosting friends at a new home for the very first time, the holiday season can be a whirlwind. But the schedule of celebrations can be even more complicated for someone planning to search for – and purchase – a home this time of year.

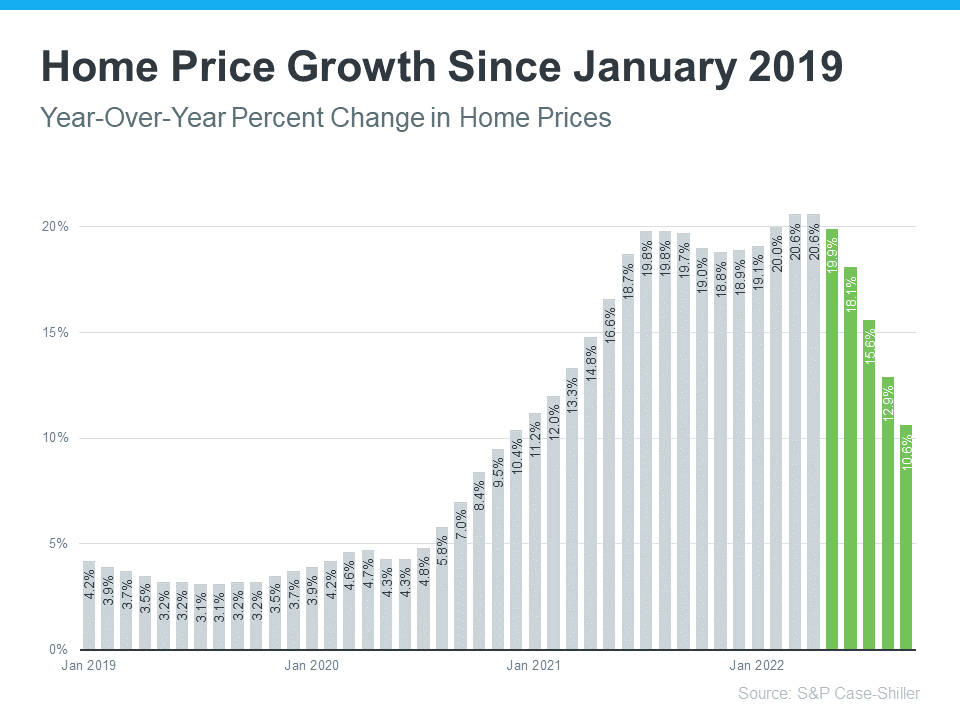

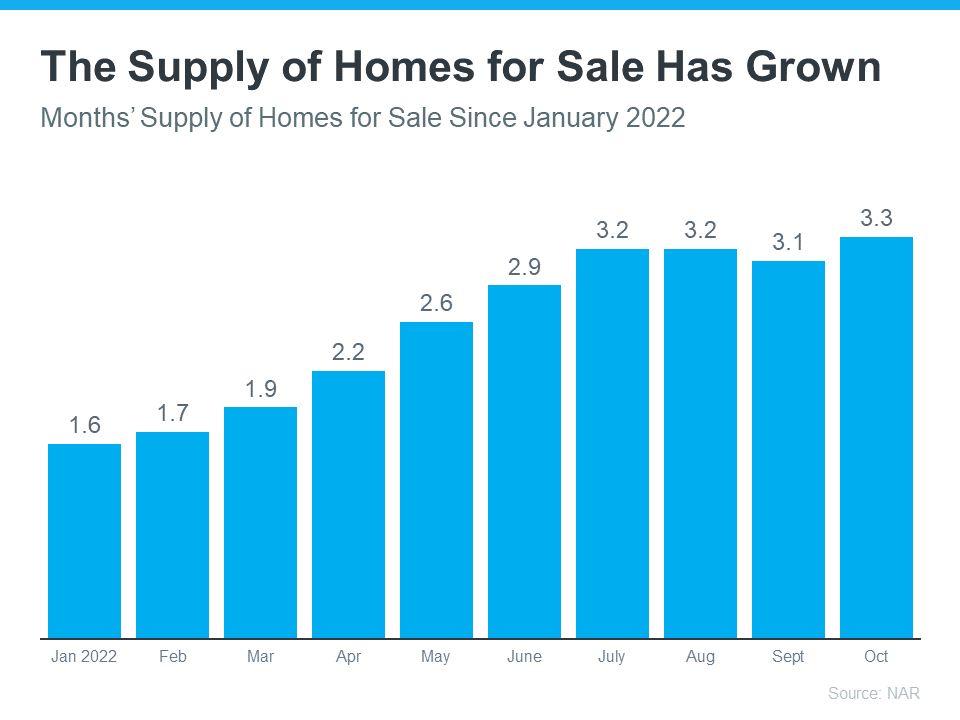

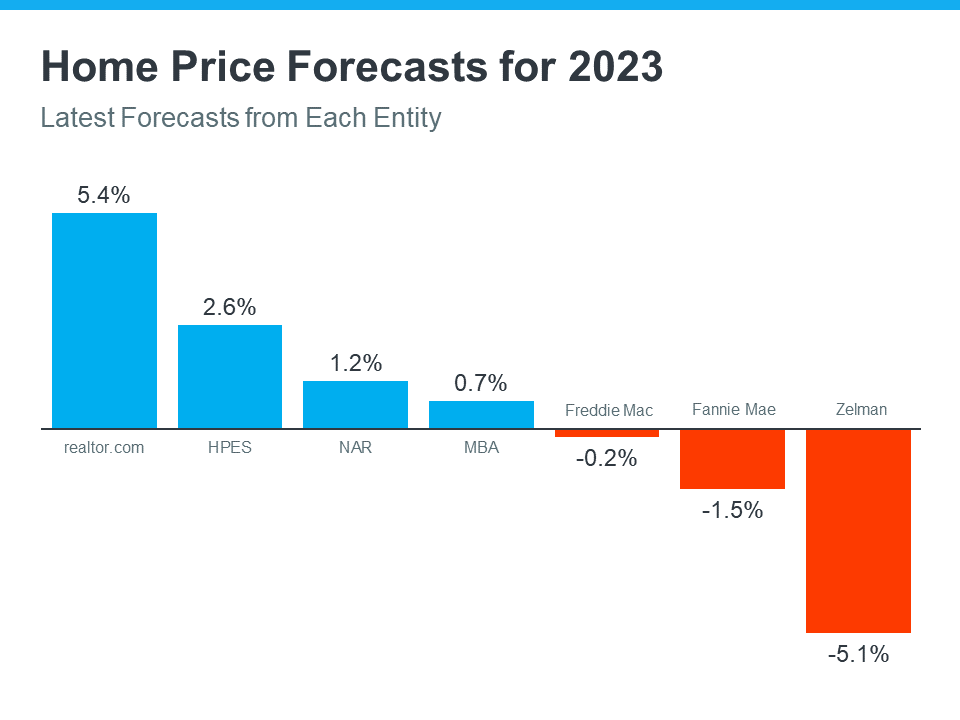

2022 has seen shifting trends in the housing market, placing a bit more power back in the hands of buyers. While competition for homes is still high, the days of fierce bidding wars and little-to-no inventory are in the rearview mirror for some areas.

Looking to buy a home before ringing in the New Year? Consider these recommended tips from experienced RE/MAX agents.

Work with qualified professionals

Working with a reputable, full-time real estate agent can help alleviate much of the stress of the homebuying process – in any market or season.

“Talk with an experienced agent who knows the market, knows your price point, and knows what to offer. What is it going to take to win in this specific area?” says Angelica Olmsted, an agent with RE/MAX Professionals in Denver, Colorado. “We still have some nooks throughout Denver that are very competitive. And if your agent doesn’t have their finger on the pulse right now, that could hurt your homebuying process in the long run.”

Because buying a home requires trust and constant communication among everyone involved, it’s wise to find a highly compatible agent.

“Find a REALTOR® you can trust and who understands your goals. You can interview several or get a referral from someone who has gone through the process and had a good experience,” says Cheryl Leatherwood, an agent with RE/MAX First in Baton Rouge, Louisiana. “Let your REALTOR guide you on the steps needed to make your homebuying process as smooth as possible.”

She adds, “Before you shop for your new home, know the price range you’re most comfortable being in, and know what that means in regard to the down payment, closing costs and monthly payments.”

Homebuying and financing often go hand in hand. Olmsted and Leatherwood both recommend contacting a mortgage broker or lender as early as possible to set realistic expectations for the home search.

“Talking to a lender and understanding the fluctuation with interest rates right now is also really important because we are seeing those change day to day,” says Olmsted, adding that having both a reliable agent and lender can be especially helpful in a market like this.

Understand market conditions and annual patterns

In many locales, the years-long seller’s market has begun to balance in recent months. This means current homebuyers and sellers are facing drastically different – and for some, brand new – market conditions. But in addition to overarching market trends, seasonal patterns also pop up annually.

“During the holidays, there’s typically less inventory available. It’s a time where moving is more of a need because of an upcoming life event, like a job change. It’s not as popular of a time to move simply because you want a bigger house – it’s more of a time of necessity,” Olmsted observes.

She points out that the recent rise in interest rates may be preventing some buyers from entering the market, possibly opening up more inventory for those who do intend on buying soon.

“I think with the recent increase in interest rates, fewer buyers can be a good thing, as it means less competition,” she continues. “The interest rates can really work in your favor because fewer people are out there competing for the same home. What’s a con for one person can be a pro for another.”

Leatherwood, too, has seen a tremendous market shift in her locale – and shares how the impacts on sellers are affecting buyers.

“Current market conditions are having a tremendous impact on home sales. Sellers are having to rethink their strategy and their expectations as we have quickly shifted from a complete seller’s market to a more balanced market,” Leatherwood says. “The real estate market will remain strong – but we are in a situation where sellers are offering more concessions to attract buyers.”

Prepare for timeline flexibilities

Most people are busy during the holiday season – and that includes those who work in lending, inspecting, repairing, and moving services, too. When buying a home toward the end of the year, buyers can expect timelines to potentially be rushed or elongated. Either way, national holidays and annual business closures could influence the timing of the purchase and move.

“You have to account for holidays in your deadlines,” Olmsted says. “A process that could have been closed in three weeks can turn into four weeks just because of business closures. Try to be flexible and realistic when it comes to those dates and deadlines.”

During the holiday season, it’s not uncommon for buyers and sellers to push off the closing date or enact an arrangement where the seller rents their house from the new buyer in order to move after the holidays have ended.

“Sellers may want a longer closing date so as not to have to move during the holidays. They are motivated to sell if they have a home on the market at this time of year, however they may want to push off physically moving for a few weeks,” Leatherwood explains. “This is a time for buyer’s agents to have conversations not only with their buyers, but also with listing agents to create an arrangement that works for everyone.”

Plan ahead for the big move

Once buyers have locked down a home, they can take steps right away to prepare for an upcoming move. Once a date is set, contact a moving company ASAP to get on their schedule. If it’s during the holiday season, there may be less flexibility with days – so it’s best to be aware in advance. And if the moving date is right after the holiday season, securing movers is one task off the checklist.

Plus, a benefit to buying a home during the holiday season is the great deals sometimes found on home goods, furniture, appliances, and more.

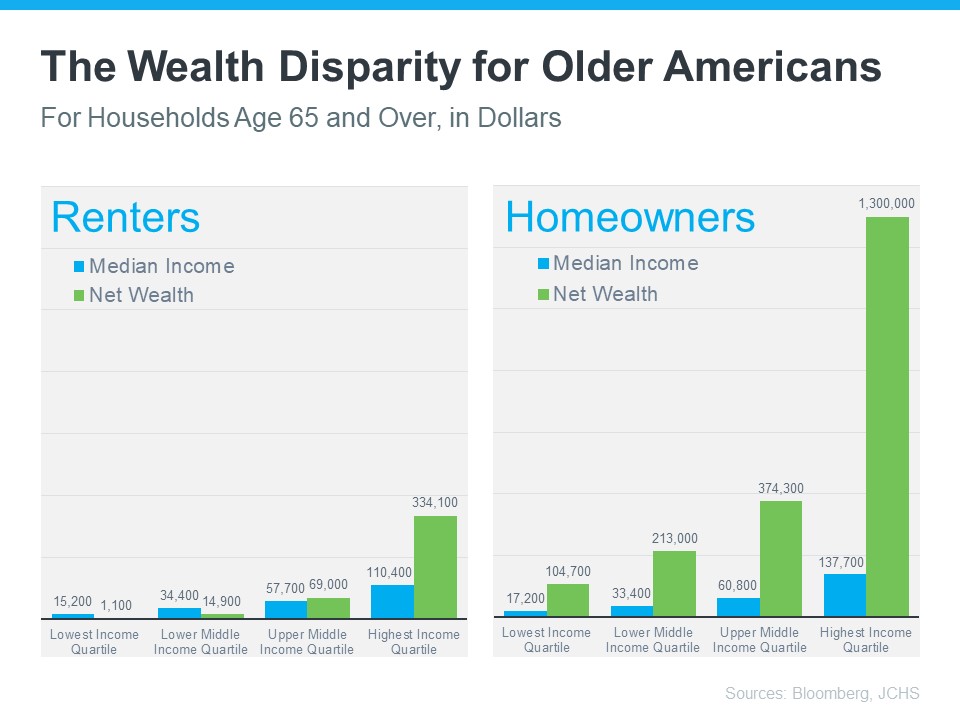

Ultimately, there can be advantages to buying and selling during any season – including the end-of-year holidays – whether it’s a potential for more inventory, less competition, or motivation to unpack in time to host an upcoming meal with loved ones. For some, reaching the milestone of homeownership may just be at the top of their holiday wish list.

“If someone is motivated to purchase or sell, they are still going to make decisions based on their long-term real estate goals,” Leatherwood says. “They won’t use the holidays as an excuse to not move forward in a life-changing decision.”

![Reasons To Sell Your House This Season [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/12/08121045/Reasons-To-Sell-Your-House-This-Season-MEM-1046x2601.png)

![Winter Home Selling Checklist [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/17130959/Winter-Checklist-MEM-1046x1715.png)