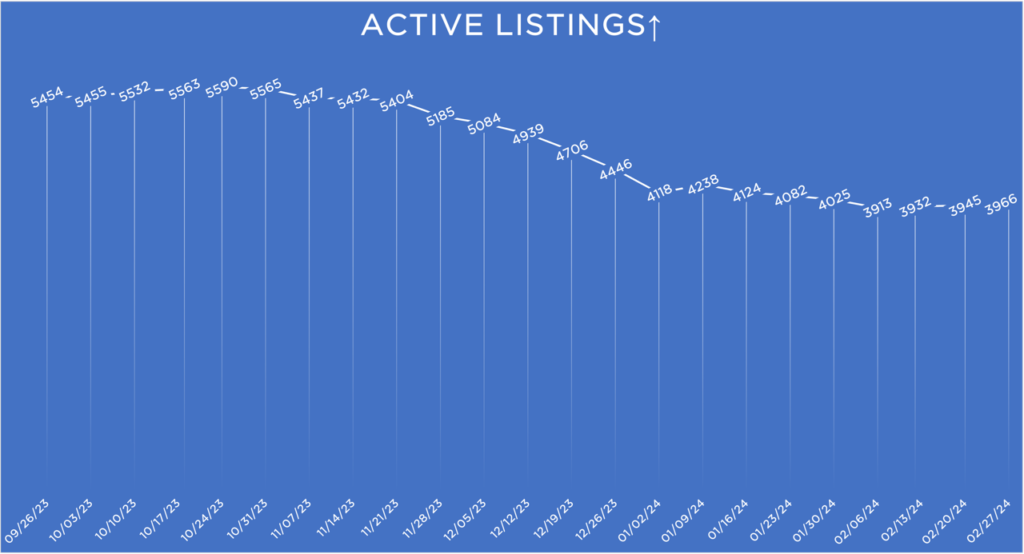

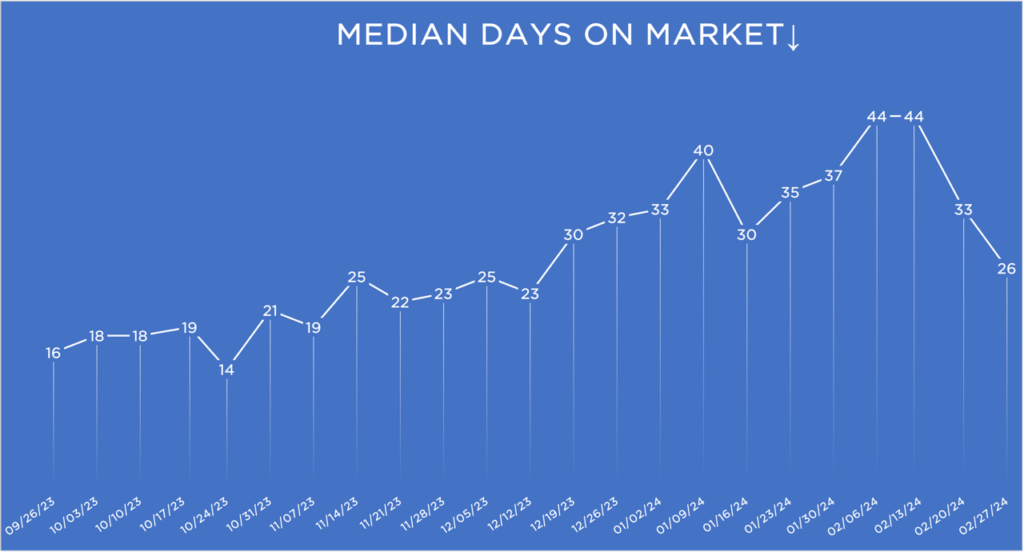

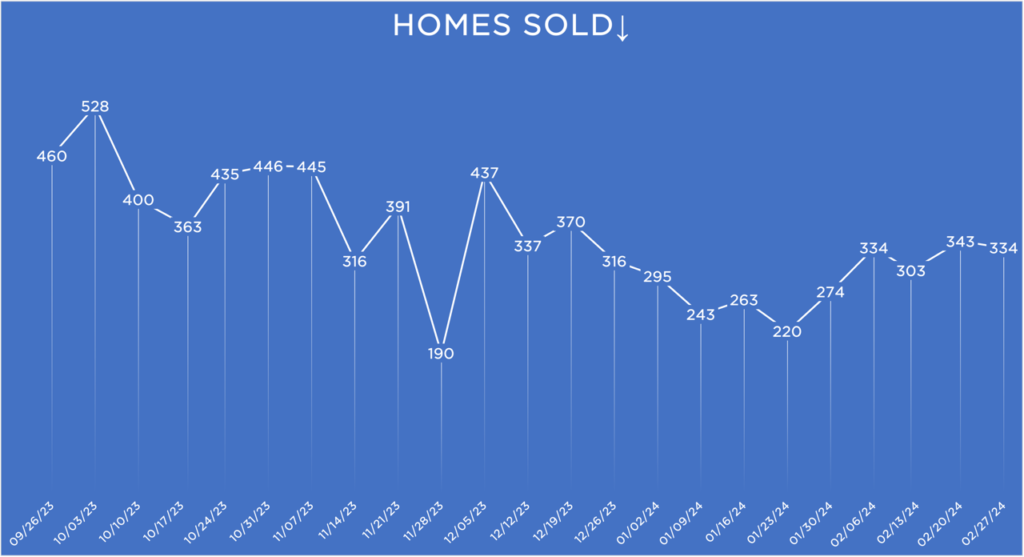

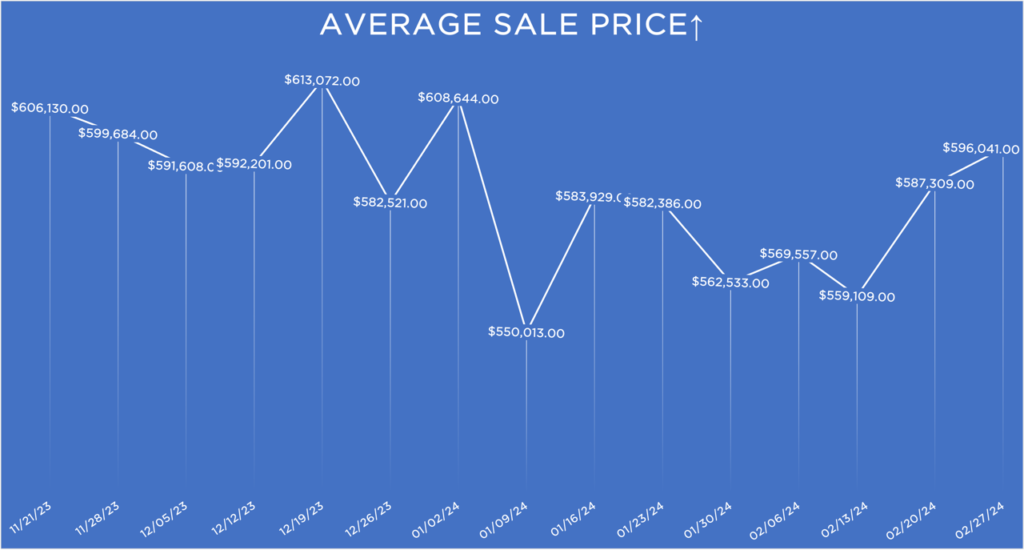

The Portland real estate market saw some surprising surges in the average sale price and buyer demand. All this with no thanks to interest rates! Let’s take a look at the stats and trends. For the second week in a row, the average sale price has come in higher than the previous week and about 4% higher than what we saw last year – 3.9% and 4.2% higher over the past weeks. This is a switch from the flat numbers we’ve been seeing through January and the start of February. This may be the start of a new trend, with the market bottoming out in mid-February and starting our typical Spring rise in sale prices. The supply of homes for buyers to choose from was flat with a slight increase of about 1% from the previous week.

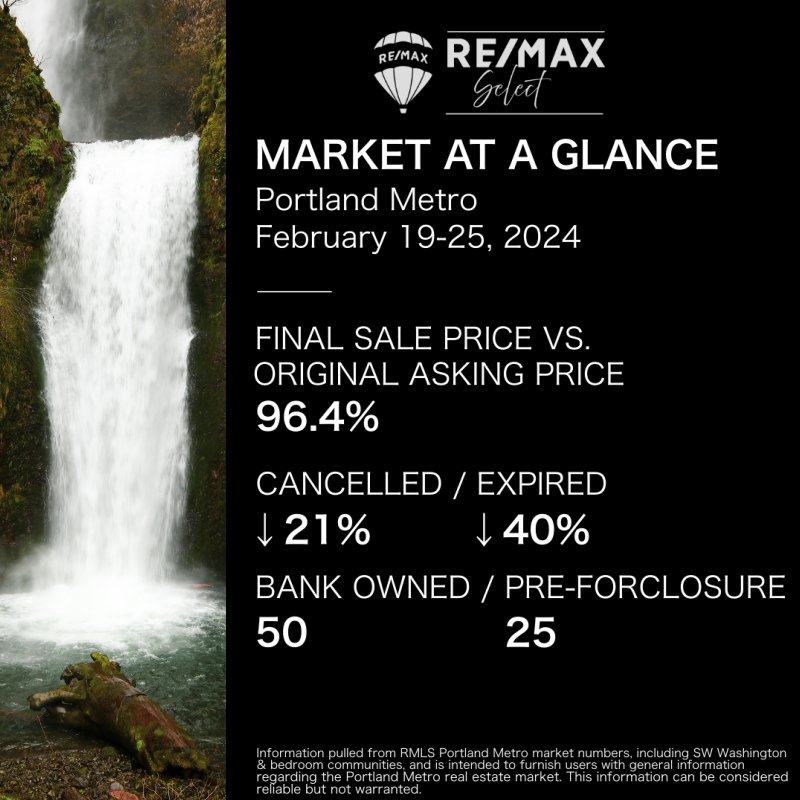

The number of homes that hit the ‘for sale’ market this last week was down from the previous week, but it is still more than we saw last year. What has stayed the same is the supply and demand dynamic that we’ve been following over the last couple of months. Once again, the number of new contracts agreed to by buyers and sellers outpaced the number of new listings by about 570 to 418. In addition to that, buyer demand has been stronger than last year at this time for about three weeks straight now. A number we’re watching that could be a cause for concern when it comes to buyer demand is the low number of lockbox opens, which is one of our measures of serious buyer activity in the market (buyers out looking at homes with their agents). That number has been consistently low – below last year’s- by about 20 to 25% over the last couple of weeks. That could mean that the pool of potential buyers we’re working with this year isn’t as deep as last year, and it may not take us as far as it typically does through our spring buying season. The other option is that our spring buying season is taking longer to kick into gear – eh, maybe. It’s undoubtedly been cold out there. We usually like to see a nice week of sunny, warm weather after either the Super Bowl or Valentine’s Day in the Portland metro area to kick off that buying season… wake people up, and get them out there looking at homes again. Either way, that’s a number that we’ll be keeping a close eye on, and of course, I will keep you informed. There’s still no real change in the number of foreclosure or pre-foreclosure homes on the market. The numbers that we have here are the numbers that we’ve been seeing over the past year now (give or take). We’re looking at about 75 distressed properties on the market out of a total of more than 6800 homes, active and pending. So, not a whole lot!

The positive movement we saw on the average sale price and buyer demand were no thanks to mortgage rates. Mortgage rates are still higher than they were last year at this time, and they still haven’t moved much this last week. The best rate I saw on Thursday morning was 6.5% for the 30-year fixed. Again, that’s the best case scenario, with most lenders probably at 7% or higher, and that’s pretty much what we’ve been seeing over the last 2 or 3 weeks now. So, there are some interesting developments this week and probably more en route in the coming weeks. If you are new to the channel, hit that subscribe button and make sure that you don’t miss any future updates. Please give the video a like if you enjoyed the content. I’d really appreciate it! Have a great weekend, and I will see you right here next week!