Posted by: Josh Lehner | May 19, 2021

Oregon Economic and Revenue Forecast, May 2021 | Oregon Office of Economic Analysis (oregoneconomicanalysis.com)

This afternoon the Oregon Office of Economic Analysis released the latest quarterly economic and revenue forecast. For the full document, slides and forecast data please see our main website. Below is the forecast’s Executive Summary and a copy of our presentation slides.

Economic growth is surging as the pandemic wanes. Thanks to federal fiscal policy, consumers have higher incomes today than before COVID-19 hit. Now they are increasingly allowed to and feel comfortable resuming pandemic-restricted activities like going out to eat, on vacations, getting haircuts and the like. The outlook for near-term economic growth is the strongest in decades, if not generations.

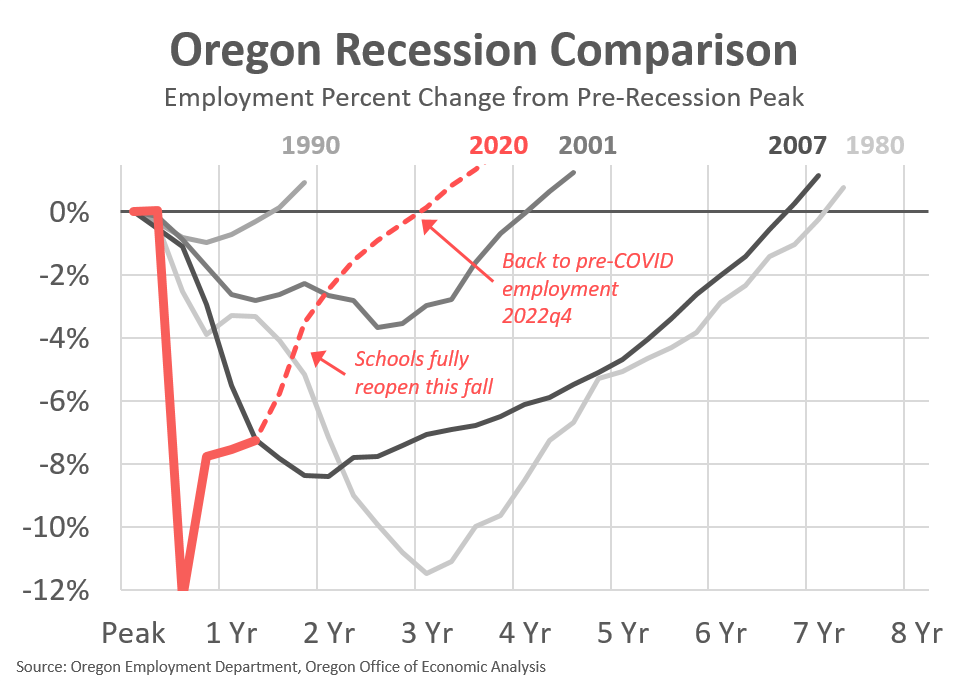

Oregon’s labor market is expected to return to full health during the upcoming 2021-23 biennium. With the strong near-term outlook for consumer spending, job growth is front-loaded such that the largest employment gains will occur this summer and fall. Total employment in Oregon will surpass pre-pandemic levels in late 2022 with the unemployment rate returning to near 4 percent in 2023.

While a jobs hole remains in the labor market, the same cannot be said for household incomes. Currently incomes in Oregon are 20 percent higher than before COVID-19 hit, thanks in larger part due to the temporary federal measures put in place. Excluding the direct federal aid, incomes are back to pre-pandemic levels and expected to grow 6-7% this year and next.

However, with such a strong consensus near-term outlook, the risks do primarily lie to the downside. The risk is that supply cannot keep pace with demand. The path forward may be bumpier than expected, even if the trajectory is up. Already supply constraints have emerged in semiconductors, lumber, and rental cars to name a few. More bottlenecks are likely on the horizon. Furthermore, running through all of these issues is labor. Attracting and retaining workers is already much more challenging than expected given the economy went through a severe recession last year. There are a variety of simultaneous factors impacting the number of available workers including strong household finances, the virus itself, and lack of childcare or in-person schooling. While the temporary pandemic-related constraints will ease in the months ahead, the labor market is expected to remain tight for the foreseeable future in large part due to demographics and the large number of Baby Boomers retiring.

With the prospect of strong growth and near-term supply constraints, the possibility of an overheating economy has quickly replaced fears of a long-lasting, demand-driven recession like the past few cycles have been. Undoubtedly inflation will pick up in the months ahead. Production costs are rising quickly in part due to capacity constraints and bottlenecks. However these price pressures are coming off of a low base and are largely expected to be transitory. The Federal Reserve so far has indicated it will only become concerned should price pressures turn persistent. Given the overall economy is not at full employment, and generally strong wage growth is needed for persistent inflation, almost by definition the current bout of inflation is transitory.

In May of odd-numbered years, the revenue forecast takes on added importance. With the legislature in session, the May forecast determines the size of General Fund resources available for the upcoming budget, and sets the bar for Oregon’s unique kicker law.

Oregon’s state revenue outlook continues to brighten as the income tax season unfolds. Personal and corporate tax collections are booming despite the job losses and business woes brought on by the COVID pandemic. Tax collections based on consumer spending are also posting large gains. With the near-term economic outlook looking very strong, healthy growth in tax collections is expected to continue into the 2021-23 budget period.

In a typical year, the income tax filing season is winding down when the May forecast is produced. At that point, the vast majority of payments have been processed, and we have a good idea of how the tax season turned out. This year, the tax filing deadline was extended to May 17th due to the pandemic, leaving many returns yet to be processed. This injects added uncertainty into the outlook. In particular, there is the potential for a significant revenue surprise (up or down) in the final weeks of the biennium. That suggests that leaving a large ending balance would be wise. Also, it is possible that the size of the kicker credit for next year will change significantly from the current estimate when the kicker is certified this fall.

So far, with around half of payments having come in, the tax season is turning out to be a healthy one. Payments are expected to reach an all-time high by the end of the fiscal year. While there is still a large amount of payments outstanding, most of this season’s refunds have already been issued. Taxpayers who are expecting refunds tend to file returns earlier than those making payments. Refunds are significantly lower than they were last year, due largely to the kicker credit issued in 2020. This year, refunds include $81 million in automatic adjustments sent to 164,000 taxpayers who paid taxes on unemployment insurance benefits. In March, the federal government exempted the first $10,200 in unemployment benefits from taxation. The Oregon Department of Revenue has sent refunds to taxpayers who filed before the exemption was announced.

In light of massive job losses, Oregon’s General Fund revenue outlook for the current biennium was revised downward by around $2 billion immediately following the onset of the COVID-19 pandemic. As of the May 2021 forecast, this hole has more than been filled, with the outlook now calling for significantly more revenue than was expected before the recession began.

Many factors are playing into the unexpectedly strong revenue collections, but two reasons stand out. First, an unprecedented amount of federal aid has far outstripped the size of economic losses. As a result, personal income is up sharply in Oregon despite job cuts. Second, during the typical recession, Oregon has lost a tremendous amount of revenue associated with sharp declines in investment and business income. This time around, asset markets and profits have remained at or near record highs. The baseline outlook prior to the recession called for income growth to slow. A tight labor market was expected to weigh on growth, and asset prices and profits were expected to return to sustainable levels. None of this came to pass, leading to an expected personal income tax kicker of $1.4 billion and a corporate tax kicker of $664 million.

Looking forward into the 2021-23 biennium, the increasingly rosy economic outlook suggests healthy tax collections will persist. A broad consensus of economic forecasters is calling for near-term output growth to be the strongest seen in decades. Given Oregon’s unique kicker law, a booming economic outlook requires an equally aggressive revenue outlook to match it. Taxable income is expected to continue to post healthy gains, showing no evidence of the economic shock we are living through. The outlook for General Fund tax collections has been revised up by around 5% over the next few years. This translates into significantly more resources for policymakers.

Although budget writers have a lot more to work with, a good deal of caution is required and savings are a must. The kicker law dictates that we stick our necks out with an aggressive revenue outlook, exposing us to the risk of a large budget shortfall should growth stall. Of primary concern are nonwage forms of income including profits and the return on investments. With a healthy underlying economy, economic forecasters are calling for continued growth in stock prices, profits and the like. Although valuations are unsustainably high right now, forecasters predict underlying economic activity will catch up over time. Unfortunately, this does not mesh well with our past experience. Profits and capital gains often evaporate overnight, which always puts Oregon’s budget in a hole.

See our full website for all the forecast details. Our presentation slides for the forecast release to the Legislature are below.