https://www.mba.org/news-and-research/newsroom/news/2023/10/16/prepared-remarks-of-mba-president-and-ceo-bob-broeksmit-cmb-at-the-2023-mba-annual-convention-and-expo?distinct_id=QrhrNqPEx&user_email=goodnightchristy%40gmail.com

Adam DeSanctis

PHILADELPHIA (October 16, 2023) – Bob Broeksmit, CMB, MBA President and CEO, delivered the following remarks at MBA’s 2023 Annual Convention and Expo.

[Please Note: These are prepared remarks. Mr. Broeksmit may add to or subtract from these remarks during the course of his presentation. Portions of the text may be omitted during the speech.]

Thank you!

It’s great to be together again. I look forward to seeing you all year long. And I think we all needed this conference more than usual.

We all know that times are tough. The market is rocky, and margins are tight. You’ve spent every day of the past year making hard choices and fighting just to reach the next day. It’s been a real grind. And it may not end anytime soon.

But this conference is your chance to escape, for just a few days. It’s a good time to look beyond what we’re doing and remember why we do it. And it’s a chance to find strength and support in a community of peers.

We’re in this together. And make no mistake – we will all come through this together!

This is my 6th year speaking at Annual as MBA CEO.

Normally, I talk about the remarkable work you did over the previous year. Then I look at what we did on your behalf – the battles we fought and the victories we achieved. I close by reviewing what lies ahead – the policies we’re shaping, and the progress we hope to make. My tone is usually positive and upbeat.

But not this year.

I’m not upbeat.

Frankly, I’m upset.

To be clear, you still did inspiring things in the past 12 months. In fact, you did heroic work. You continued to serve families at the highest level. You continued to make the American Dream possible for millions of people.

By the same token, the MBA supported you every step of the way – residential, multifamily, and commercial. We achieved some great policy victories, at the federal and state levels. We defeated some bad ones, too. With margins tight, we drove efficiencies that hopefully helped you succeed and stay in the black. Our work on your behalf is even more important in a down market.

But here’s the thing.

While you’re fighting to survive, and while we’re fighting for you, Washington, D.C. is fighting against you. At a time when you and your customers need relief, you’re at risk of being hit with the most extreme overregulation. At a time when you desperately need stability, your own government is sowing the seeds of profound instability.

Honestly, Washington is pushing you and our economy in the wrong direction. And no one will suffer more than American families – especially minority, low-income, and first-time homebuyers. This madness must stop before it’s too late.

MORTGAGE RATES

We’re taking this message to leaders in Washington every day. And right now, the most important battle we’re fighting is on interest rates.

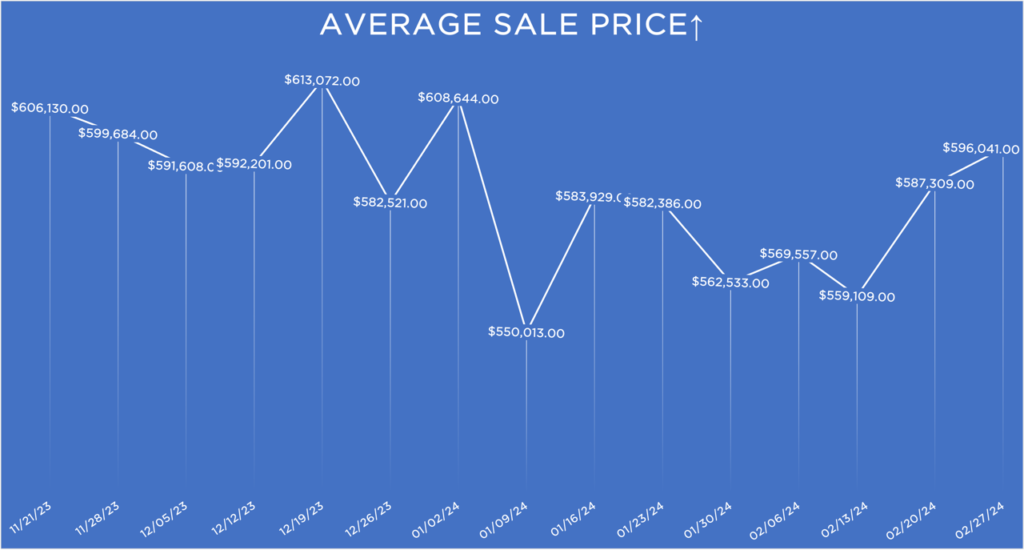

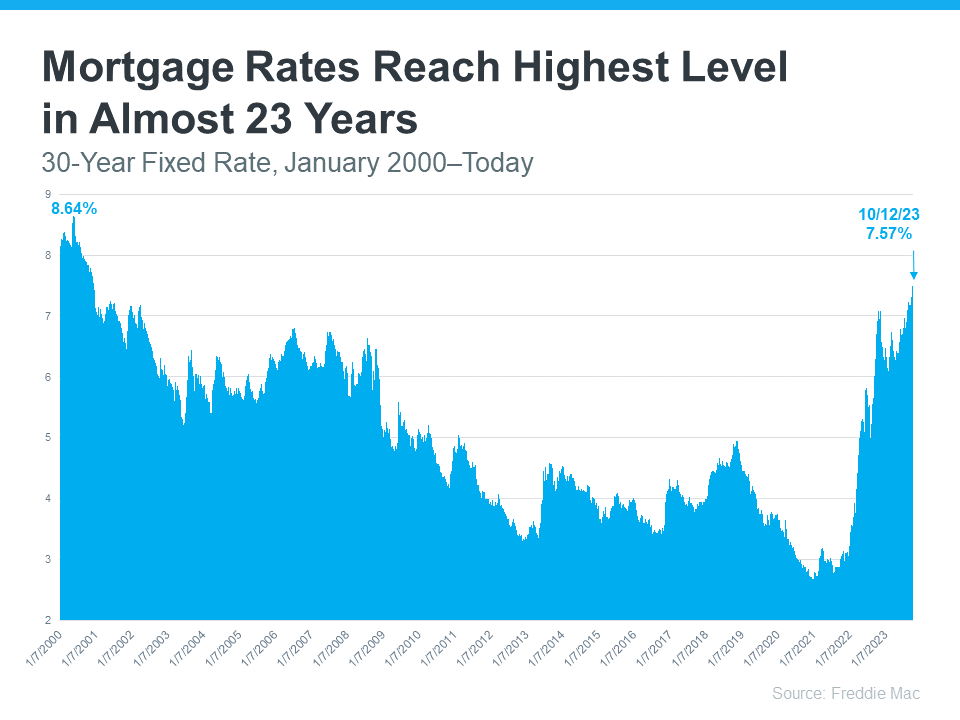

The truth is, your customers and companies can’t afford what’s happening. The past few weeks saw an unprecedented run-up in mortgage rates. We’re now closing in on 8% for a 30-year.

In direct response, mortgage applications have fallen to multi-decade lows. And the collapse in homebuying threatens the survival of countless lenders.

While we understand the Fed raising rates in an effort to control inflation, there are other factors that are keeping the spread between the 10-year Treasury and the 30- year fixed so wide.

Fiscal policy and political dysfunction are contributing – the debt limit crisis, growing federal deficits, and gridlock on Capitol Hill that results in near-miss (or actual) government shutdowns.

MBA is shouting this truth from the rooftops in Washington. And we’re playing offense.

We’re holding meetings with key officials and lawmakers in Washington and telling them what’s at stake.

We joined with the realtors and homebuilders to send a letter to the Fed.

And we’re in the midst of a media blitz.

I was recently on CNBC. And I couldn’t have been more blunt about what we need.

It’s simple. No more interest rate hikes.

No selling MBS holdings until spreads have normalized and the market has stabilized.

And we don’t just want to see these things.

We want the Fed to SAY these things, for all to hear.

You deserve clarity, not more chaos.

And the MBA will never stop fighting to strengthen your companies!

BASEL III

Interest rates are an enormous threat to you, your customers, and our entire economy.

But they aren’t the only threat.

The so-called Basel III end-game proposal is dangerous too.

The Federal Reserve, the FDIC, and the OCC are trying to implement massive bank capital increases.

They think it will make our economy stronger and more resilient.

In fact, their Basel III rules are a dagger aimed at the heart of the housing market.

We all know the threat. Washington wants banks to significantly HIKE the capital they hold against mortgage assets.

Not just mortgages, but servicing. And warehouse lines.

If this goes through, banks will pull back even further from mortgage lending and servicing, leaving consumers with less access to credit.

Meanwhile, the credit that consumers will have access to will cost significantly more.

And make no mistake – weakening demand for mortgage servicing raises mortgage rates for ALL borrowers, whether they choose IMBs or banks.

It’s almost like Washington WANTS fewer people buying homes.

The proposed implementation of Basel III is fundamentally at odds with everything our nation’s leaders are saying.

The Biden administration.

Both parties in Congress.

Banking and housing regulators.

All of them are pushing to expand sustainable homeownership for those who need it most.

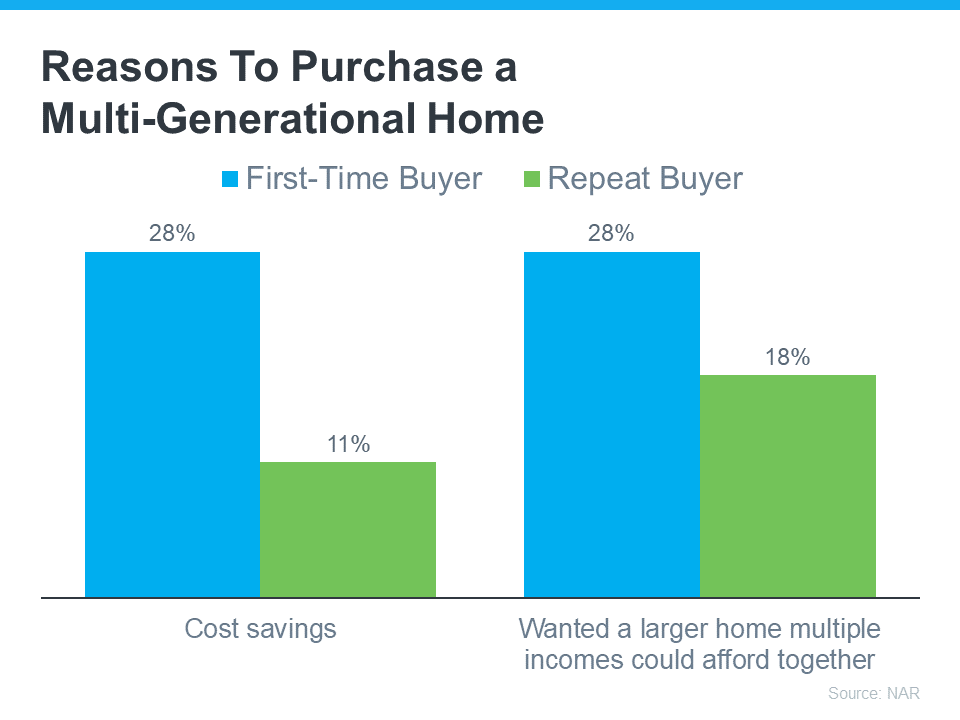

They want to close the racial homeownership gap. And they want more first-time homebuyers, especially in low- and middle-income families.

Mortgage lenders want the same thing.

Yet if Basel III goes into effect as proposed, meaningful progress is off the table. Equity will get worse, not better.

The racial homeownership gap will persist, if not grow.

And countless families won’t get a chance to buy their first home. They’ll fall behind, despite Washington’s constant promise to help them get ahead.

Regulators should have realized this.

They have a duty to analyze the harmful effects of their proposal. But they didn’t analyze it. Nor did they justify it.

They rolled out Basel III without doing the most basic due diligence – without telling us the problem they’re trying to solve.

In fact, there isn’t a problem, by their own admission.

The Federal Reserve and U.S. Treasury have consistently stated that the banking system is strong. Capital ratios of large banks have more than doubled since the Great Financial Crisis.

More than a decade of real-life experience has demonstrated that banks have adequate capital to withstand significant economic shocks. And the most recent stress test results confirmed that the banking system is safe and well-capitalized.

The verdict couldn’t be more obvious.

Basel III is a solution in search of a problem.

And it will create far more problems than it ever solves.

For the sake of homeownership and fairness for families, MBA is fighting this proposal on every front, including my testimony in the U.S. House of Representatives last month, and we won’t rest until we win!

FSOC SIFI

Basel III is bad enough on its own.

Yet Washington is simultaneously pushing another terrible idea that will compound the pain.

The Financial Stability Oversight Council is threatening to designate non-banks as systemically important, and therefore subjecting them to even greater regulatory scrutiny.

Put another way, they want to strangle IMBs with endless red tape.

Once again, the result will be fewer businesses lending to fewer borrowers, leading to less homeownership for those who need it.

A policy of this magnitude deserves the strongest possible justification. Yet FSOC provided precisely none.

It gave no proof that non-banks are systemically important.

It just says so, as if the assertion is proof enough.

It’s not. Not even close.

At the same time, like the FDIC, OCC, and the Fed on Basel, it is proposing to eliminate cost-benefit analysis as part of the designation framework process for non- banks.

That’s astounding.

If you’re going to subject non-banks to an avalanche of new regulations,

you better know the damage it will do.

MBA vehemently opposes designating non-banks as systemically risky, the same as we oppose the higher capital requirements of Basel III. They are both unwise, unnecessary, and utterly unjustified.

The MBA has always supported prudent policy and smart regulation. What we face in these two cases is neither.

It’s foolish. It’s dangerous.

And it’s likely to hurt millions of people.

Yet what’s most astounding to me is that regulators think Basel III and non-bank designation complement each other.

One top financial regulator said exactly that a few weeks ago.

He declared, that there should be, and I quote, “appropriately strong capital requirements for [large banks], complemented by greater transparency, stronger oversight and appropriate prudential requirements for non-banks.”

He went on to call this an “effective and balanced way to enhance the stability of the entire financial system.”

He might as well have said, “The beatings will continue until morale improves.” That’s what’s happening.

Mortgage lenders and consumers are already struggling with the highest interest rates in a generation.

In early October, 10 year yields reached the highest levels in 15 years.

Originations have plummeted, forcing painful layoffs and cuts at your companies.

Some of our colleagues have merged, sold, or simply gone out of business.

It’s heartbreaking.

Yet how do regulators respond?

By pushing large banks and non-banks away from mortgage lending and servicing. We can’t take much more of these beatings.

And no, morale is not improving. MBA is fighting these foolish ideas tooth and nail.

And I want you to know what we’re saying to regulators, lawmakers in Congress, and White House officials.

We’re telling them no one’s going to be left.

Seriously. If large banks and non-banks are driven from mortgage lending, who’s going to do it?

Who’s going to give that first-time homebuyer a loan?

Who’s going to help the low-income family that doesn’t have generational wealth? Who’s going to help Black and Brown Americans overcome the legacy of discrimination and build their own American Dream?

The answer is no one – and that’s unjust. The MBA will not let this happen.

We will fight for you and every American. And yes, we plan to WIN!

We were made for moments like this.

We love nothing more than taking on the biggest fights and getting results.

We proved it in the pandemic when we delivered for you in countless ways.

We proved it again over the last year, by defeating the Adverse Market Refinance Fee and DTI-based Loan Level Price Adjustments.

And while this fight is even bigger, we’re shifting into overdrive.

The MBA is building diverse coalitions to take your message nationwide.

We’re partnering with the NAACP and the Urban League to make clear that the Basel proposal will move the cause of equity in the wrong direction.

And we’re fostering unprecedented collaboration with other industries and associations.

Every day, we talk to the decision-makers at the White House and leaders in Congress.

And I can already report that there’s broad and bipartisan agreement that change is needed.

We’ll continue to speak out, and if anything, we’ll only get louder in the days ahead. Policymakers know we speak for you, which is why they listen.

But given what’s at stake, we need you to speak out, too.

Policymakers don’t just need to hear just from us right now.

They need to hear directly from you.

In the past, we’ve asked you to join the Mortgage Action Alliance and support MORPAC.

Of course, we still want you to do those things. But today, I’m calling on you to go a step further. Call your representative. Call your senators.

Warn them about the disaster in the making.

Tell them who’s going to get hurt – namely, the least fortunate and most vulnerable among your customers.

Raise your voice, early and often.

And consider submitting your own formal comment on Basel III.

Comments are due by November 30th, and regulators need to hear from you about the massive unintended consequences.

The MBA is happy to help you navigate that process – just let us know.

And while comments to FSOC on non-bank designation are already closed, we’re happy to help you make a compelling case to your elected officials.

Your voice matters in this moment.

And your membership matters more than ever before.

With your continued partnership, we can defeat these threats.

And if we keep standing together and speaking as one, we’ll come through this difficult time.

We won’t just survive.

We’ll rise by helping more Americans thrive – because that’s what you always do.

Thank you for being here, and for being part of the MBA.

Most of all: Thank you for all you’ve done, and all you’ll do in the days ahead.

Welcome back to MBA Annual!