82,338 Great Reasons to Buy a Home Today

The financial benefits of buying a home as compared to renting one are always up for debate. However, one element of the equation is often ignored – the ability to build wealth as a homeowner.

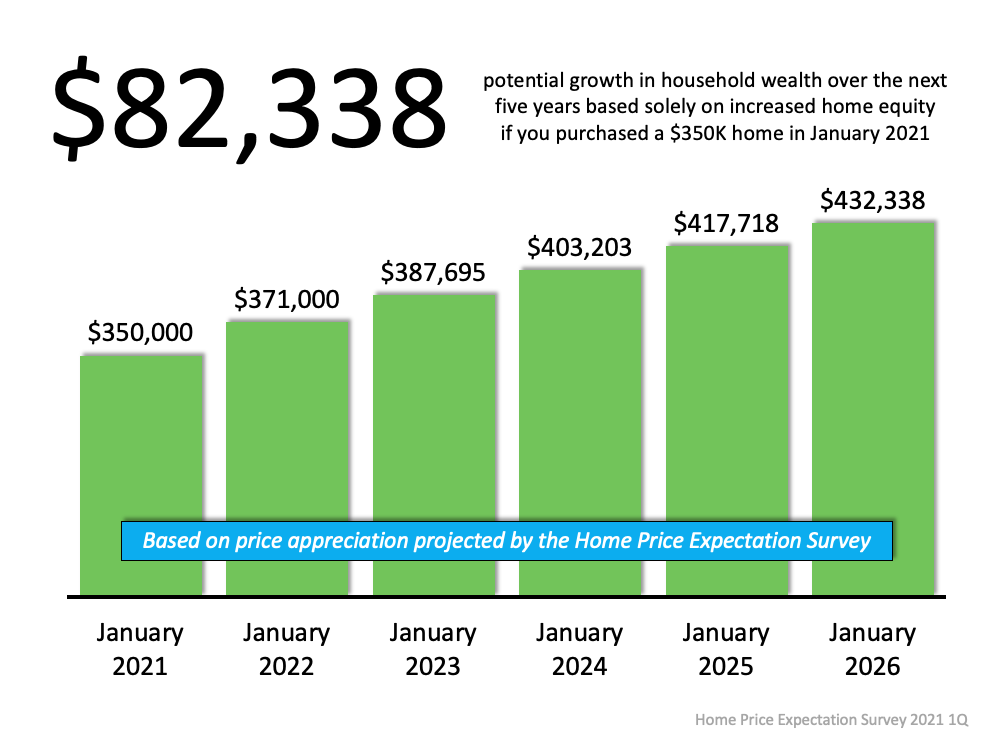

Most experts are calling for home prices to continue appreciating over the next several years. The most recent Home Price Expectation Survey, a survey of over one hundred economists, real estate experts, and investment and market strategists, expects home appreciation to increase as follows:

- 2021: 6%

- 2022: 4.5%

- 2023: 4%

- 2024: 3.6%

- 2025: 3.5%

Using their annual projections, the graph below shows the equity build-up a purchaser could earn, using a $350,000 home as an example:A homeowner could increase their net worth by over $80,000 in five years. That’s an average of $16,000 annually. That number should be in any equation determining the financial benefits of owning a home compared to renting.

Bottom Line

Homeowners are going to make a substantial amount of money in home equity over the next five years. If you’re ready to buy a home, let’s connect so you can enjoy this great benefit as well.

How Much Time Do You Need To Save for a Down Payment?

One of the biggest hurdles homebuyers face is saving for a down payment. As you’re budgeting and planning for your home purchase, you’ll want to understand how much you’ll need to put down and how long it will take you to get there. The process may actually move faster than you think.

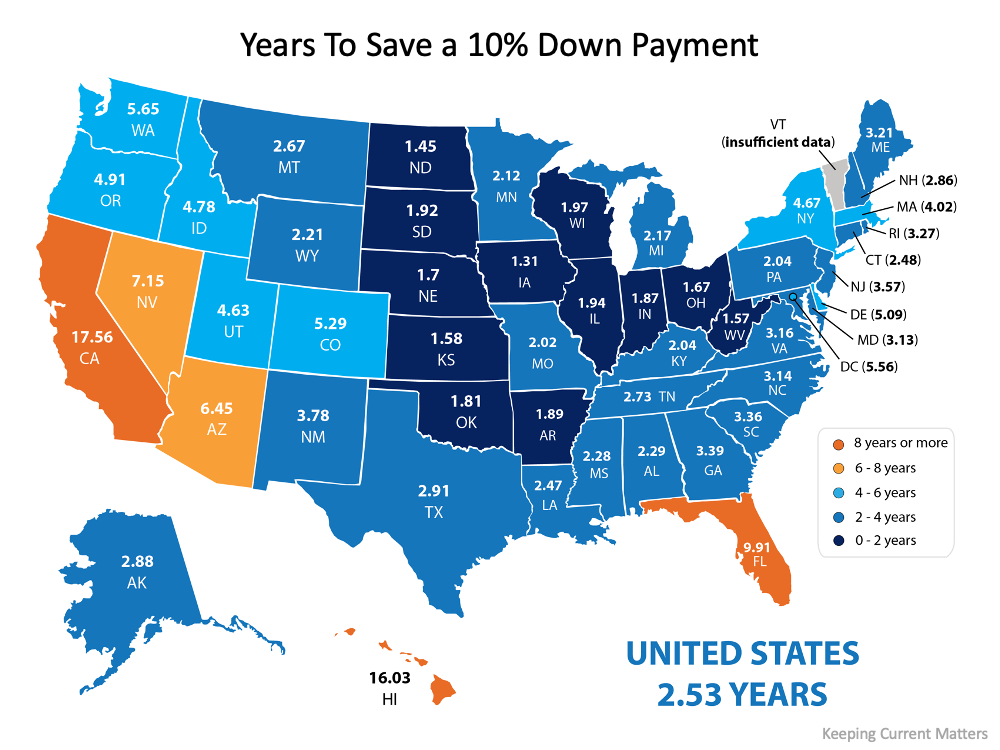

Using data from the U.S. Department of Housing and Urban Development (HUD) and Apartment List, we can estimate how long it might take someone earning the median income and paying the median rent to save up for a down payment on a median-priced home. Since saving for a down payment can be a great time to practice budgeting for housing costs, this estimate also uses the concept that a household should not pay more than 28% of their total income on monthly housing expenses.

According to the data, the national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53). Residents in Iowa can save for a down payment the fastest, doing so in just over one year (1.31). The map below illustrates this time (in years) for each state:

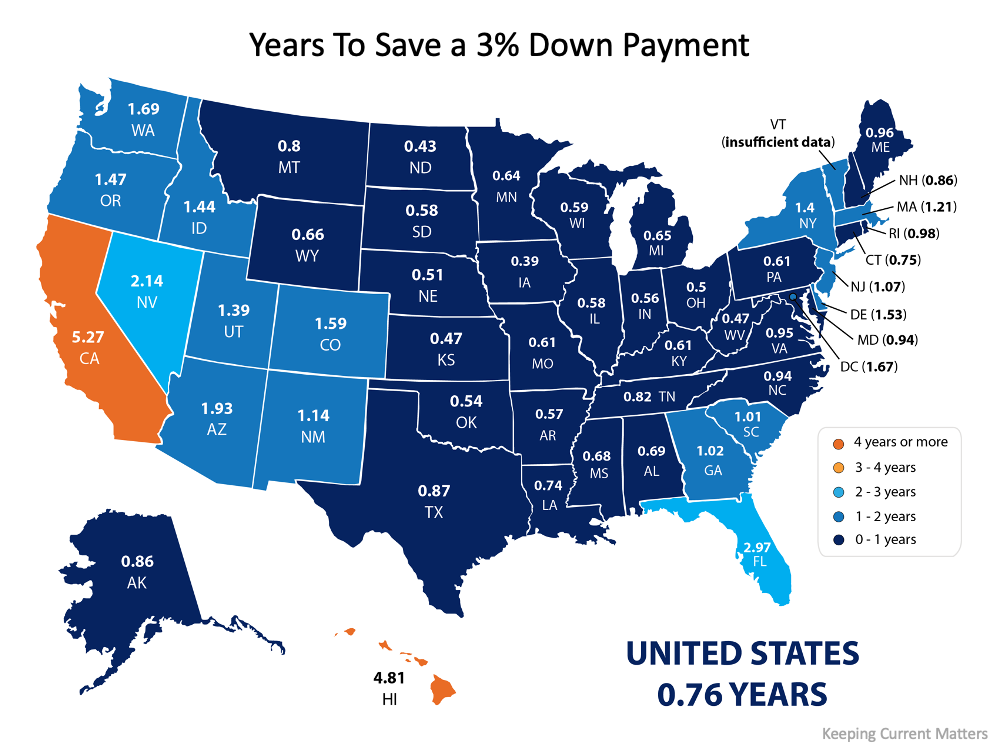

What if you only need to save 3%?

What if you’re able to take advantage of one of the 3% down payment programs available? It’s a common misconception that you need a 20% down payment to buy a home, but there are actually more affordable options and down payment assistance programs available, especially for first-time buyers. The reality is, saving for a 3% down payment may not take several years. In fact, it could take less than a year in most states, as shown in the map below:

Bottom Line

Wherever you are in the process of saving for a down payment, you may be closer to your dream home than you think. Let’s connect to explore the down payment options available in our area and how they support your plans.

What Is Real Estate?

Study Highlights How Credit Scoring Impacts Fair Lending, Minority Homeownership Rates

NAR will use new research to shape policy positions in effort to boost minority homeownership

April 8, 2021Media Contact: Wesley Shaw 202-383-1193

Study Highlights How Credit Scoring Impacts Fair Lending, Minority Homeownership Rates (nar.realtor)

WASHINGTON (April 8, 2021) – The use of new data to determine prospective buyers’ creditworthiness will increase opportunities for homeownership among Black and Latino Americans, according to new research outlined today at a virtual event hosted by the National Association of Realtors®. NAR is recognizing Fair Housing Month along with the rest of the nation this April, honoring the sacrifices made during the ongoing fight to expand equal access to homeownership and private property in America.

The paper, Tipping the SCALE: How Alternative Data in Credit Scoring Promote or Impede Fair Lending Goals, was authored by industry thought leaders Ann B. Schnare and Vanessa Gail Perry. It examines how reforms to current credit bureau data and scoring models, which exclude many common household expenditures like rent and utility payments, would provide a more comprehensive view of a household’s credit performance and dramatically increase opportunities for property ownership.

“Minorities are far more likely to be ‘unscoreable’ or have relatively weak credit scores using traditional credit bureau data,” Dr. Schnare said Thursday. “Incorporating additional data into the credit evaluation process can open doors for many deserving borrowers and boost minority homeownership rates.”

Under the new proposal, each form of alternative data would be evaluated using a newly devised five-factor “SCALE” framework that incorporates important considerations in the data’s predictive power. These include:

- Societal Values: Does it respect social and ethical norms like right to privacy

- Contextual Integrity: Regardless of predictive value, is it relevant to mortgages

- Accuracy: Does the data accurately reflect the household’s financial situation

- Legality: Would the use of the data have a disparate impact on protected classes

- Expanded Opportunity: Would the use of the data increase the number of qualified borrowers

Dr. Schnare, currently the president of her own consulting firm specializing in housing and mortgage finance, previously served as a senior vice president at Freddie Mac. Dr. Perry, a professor at the George Washington University School of Business, was a senior advisor to the U.S. Department of Housing and Urban Development during the Obama administration.

“The rise of big data greatly expands the options for credit scoring,” Dr. Perry noted. “However, predictability is not enough to justify the use of certain kinds of data. Their use must also be consistent with broader social and ethical values.”

Homeownership rates for Black and Latino Americans have lagged those of White Americans for decades, highlighting the need to review existing tools and identify new credit valuation processes.

“A borrower’s credit report and credit score are the gateway to a mortgage,” said NAR President Charlie Oppler. “But for too long, inaccurate credit reporting methods have raised the cost to borrow while limiting access to mortgage credit for prospective borrowers, particularly those from minority populations and rural communities. NAR is eager to apply this new research to help shape our policy positions and advocacy efforts in the future.”

The National Association of Realtors® is America’s largest trade association, representing more than 1.4 million members involved in all aspects of the residential and commercial real estate industries.

Home Sellers Capitalizing On All-Time High Prices

Updating Your Kitchen Countertops? Keep These Tips and Trends in Mind

Some Buyers Prefer Smaller Homes

Over the past year, we’ve had plenty of opportunities to reflect on what we consider most important in our lives. The place we call home is one of the biggest things many of us are reevaluating. George Ratiu, Senior Economist at realtor.com, shares:

“The very nature of the pandemic, through the health implications, social distancing, and need to isolate, has really brought a central focus on the importance of home for most Americans…In a sense, it has elevated real estate markets as a centerpiece of our lives.”

For some, this has spurred an interest in making a move to a home that better suits our changing needs. In a recent study on today’s homebuyer preferences, the National Association of Home Builders (NAHB) states:

“When asked more specifically how the pandemic may have impacted their preference for home size…21% or about 1 out of every 5 buyers, do want a larger home now as a direct result of the health crisis, while another segment – 12% – would prefer a smaller one instead.”

While you might expect more time at home to lead to a need for more space, it’s interesting that a significant portion of homeowners actually want less. For those who own larger homes right now and have a desire to move, today’s housing market is full of opportunities. Danielle Hale, Chief Economist at realtor.com, explains:

“In a real estate market that is tipped in the favor of sellers, boomers and older homeowners are really the ones holding the cards…Those who are selling homes can use the profits to help them buy new ones.”

As a homeowner today, you likely have equity that can be put toward the purchase of your next home. With the equity growth homes have seen over the past year, you may have more than you think, which can help significantly as you make a move into your next home. According to a report from the National Association of Realtors (NAR):

“Home sellers cited that they sold their homes for a median of $66,000 more than they purchased it. Sellers 22 to 30 years gained the least at $33,400 in equity compared to sellers 66 to 74 years gained $100,000 in equity as they likely had lived in their homes for a longer period of time.”

Despite the benefits of growing home equity, some homeowners are still hesitant to move and could be considering remodeling or making changes to their current space instead. However, if you’ve thought about aging in place rather than downsizing, you may want to reconsider. The U.S. Census Bureau points out:

“Of the nation’s 115 million housing units, only 10% are ready to accommodate older populations.”

If your house is no longer the best fit for your evolving needs, it may be time to put your equity to work for you and downsize to the home you really want.

Bottom Line

Today’s housing market favors homeowners who are ready to sell their houses and make a move. If you’re thinking about downsizing this year, let’s connect to discuss your options in our local market.

Americans Are Turning Spare Bedrooms Into Giant Closets

As stores disappear, shopping in your own wardrobe becomes the ultimate luxury.

Amanda MullMay 2021 Issue

https://www.theatlantic.com/magazine/archive/2021/05/giant-closets/618393

This article was published online on April 8, 2021.

When I was a kid, my mother loved to take me out for some light trespassing. This was the 1990s, during which the Atlanta metropolitan area’s population grew nearly 40 percent, and housing construction boomed to match. McMansions were sprouting up on seemingly every tract of available land in my family’s once-modest suburb, and my mom—I say this affectionately—is the nosiest person alive. Often, in the middle of running errands, she’d whip her station wagon into some new development, surveil the scene until she found a house that looked finished enough, and see if the front door was unlocked. Or maybe the side door.

Even when I was in elementary school, her behavior struck me as wild. Mom insisted that the builders left the doors open so people would come in, look around, and buy the houses. I’m still not sure what to make of this logic; it’s difficult to measure your own family’s weird behavior against what happens unseen in other families.

What I did see, though, were the interiors of the houses other families would inhabit. In spite of my worries about going to child jail for crimes against McMansions (as a white kid in a mostly white suburb, I had a limited sense of the more dire consequences we might have faced if we hadn’t blended in quite so well), I understood instinctively why my mother loved traipsing through them. It was anticipatory voyeurism, an opportunity to gaze upon the granite countertops and built-in bookshelves that would soon greet the upper-middle-class families streaming into Atlanta from the Northeast and Midwest. It was also aspirational; maybe someday we’d replace our laminate counters, which I could already tell were not as fancy as the gleaming, speckled slabs of stone we admired.

Mom’s favorite parts of these houses were the kitchens and bathrooms, which are traditionally the spaces that builders rely on to endear buyers to a property. I, on the other hand, loved the closets. Our house, built in the early ’80s, had the then-basic suburban version—two bifold doors obscuring a rod for hangers and a shelf above it. In the newer homes, though, the walk-in reigned supreme. The concept blew my mind: One day, when I grew up, I might have so many pretty clothes that they’d need their own tiny room.

At first, my fascination felt like mine alone, but I soon saw it reflected in the pop culture I had begun voraciously consuming. The enormous closets of Candy Spelling, the wife of the Beverly Hills, 90210 producer Aaron Spelling, were a tabloid mainstay for much of the ’90s. In the 1995 movie Clueless, the fashion-obsessed main character uses a computer program to dig through her wardrobe; a motorized system then brings forth her selections. The 2000s gave us MTV Cribs, which took viewers inside sprawling celebrity homes, and made Mariah Carey’s department-store-scale dressing quarters the stuff of legend. And in 2008, when Carrie Bradshaw agreed to marry Mr. Big in the Sex and the City movie, she refused an engagement ring—instead, she wanted “a really big closet.”

Since then, with the help of ever-cheaper clothes, more and more Americans have sought to follow Carrie’s lead. The closet has transformed both spatially and spiritually, from cramped afterthought to personal sanctuary. At the very high end, closets can span multiple rooms and comprise a near-limitless set of amenities—vanities, desks, wet bars. They can even bear an uncanny resemblance to boutiques. As shopping continues to shift online, the ultimate luxury might be building a store of your own.

None of this is new; in fact, it’s very, very old. From the 1300s through the 1800s, Europeans used the word closet to refer to a space that really was a room unto itself. As the late architecture curator Henry Urbach once explained, the term then described “a place for retreat, prayer, study, or speculation.” Such rooms were also used to display precious objects, but above all they were havens, their purpose as much emotional as functional.

What most Americans now think of as a closet—a small void adjacent to a larger room—first emerged around 1840, when consumers found themselves needing a place to store all the goods that industrialization had produced. This closet “obscured itself by receding into the wall, and it attempted to ‘disappear’ the family’s stuff,” writes Shannon Mattern, an anthropologist at the New School. In this way, it allowed people to “relish in consumption and enjoy their material possessions”—but discreetly, while “maintaining a semblance of frugality and moral propriety.”

That model held for the next century or so, until the postwar American economy lurched into motion, setting the country on the conveyor belt that would eventually deliver it to Kylie Jenner’s mirrored hall of designer handbags, a tour of which has been viewed more than 15 million times on YouTube. Prosperity settled in the suburbs, where millions of families moved into progressively bigger homes. Today, the average new single-family home is more than 1,000 square feet larger than it was in the early 1970s, even though new homes have, on average, fewer people living in them. (Regardless of Americans’ lack of need for giant houses, our zoning laws create them; many local governments have made building apartments or condos effectively illegal, and they are supported in this by homeowners, many of whom fear attracting less wealthy neighbors but welcome anything that pumps up property values, such as bigger houses down the street. Developers are happy to comply.)

American homes not only have more space and fewer people than they once did; they also have a lot more stuff. “We’re conditioned that we need the right thing for the right activity,” Jill LaRue-Rieser, the senior vice president and chief merchandising officer for the custom-storage company California Closets, told me. As clothing in particular has gotten less expensive and more bountiful, big closets have become a selling point unto themselves. “The builders really figured it out,” she said. “If they could hook women with enough space for their shoes, they could sell the whole house.” Which is why, for decades, the country’s closets have had no reason to do anything but grow, fueling the perpetual-motion machine of the modern wardrobe—you have more space, so you don’t hesitate to buy more stuff, but eventually your big new closets seem cramped and small. At that point, maybe it’s time for a new place with even bigger closets.

This cycle kicked into high gear in the mid-’90s, as HGTV helped turn home improvement into a spectator sport. Unbeknownst to us, my family’s habit of browsing new houses was an expression of a much more widely felt curiosity about how others lived—and about how viewers could maybe live one day, too. Since the HGTV channel launched, in 1994, with a modest slate of shows about remodeling and interior design, it has become a cultural juggernaut; in 2019, it had the fourth-highest viewership of any cable channel. By giving people insight into how they might transform their homes, a process that had long been opaque, it’s been a tremendous boon to the home-improvement industry. When HGTV started, Home Depot and Lowe’s drew a little more than $18 billion in combined net sales; by 2018, that number had grown to almost $180 billion. Once viewers understood what was possible, many of them became intensely interested in changing their homes—and the era’s builder-grade, bare-bones walk-in closets provided a low-risk, high-reward project.

Home-improvement entertainment and wealth voyeurism have since joined forces with social media: Pinterest runs on the energy generated by people plotting the homes and wardrobes of their dreams. YouTube video tours of particularly grandiose closets rack up millions of views. On Instagram, aesthetically pleasing home-organization techniques are hungered after so ferociously that the Home Edit, which began as two friends cleaning out closets in Nashville, now has more than 5 million followers, a Netflix show, and a line of products at the Container Store—a company that, incidentally, opened two closet-only concept stores in the months before the pandemic began.

For the truly acquisitive, working within the dimensions of existing closets doesn’t cut it. That’s where other parts of America’s unusually giant homes come in. “People are using spare rooms,” Michaelle Bradford, the editor of Closets & Organized Storage, an industry trade publication, told me. Guest rooms are nice, but your parents might come to visit only twice a year. Your clothes, meanwhile, are a permanent resident of your home.

Bradford said that converting a spare room to a closet has become particularly popular in recent years because it accommodates various internet home-design fantasies: natural lighting, room for a center island, seating areas, and space to show off particularly beloved collections of sunglasses or handbags or sneakers. “If people have something they value a lot, they want to create a perfect space for it, to highlight it,” she told me.

For years, this level of fantasy fulfillment was available only to the wealthy. More recently, though, materials prices have come down and DIY products have become more sophisticated. California Closets and Martha Stewart recently launched a joint line of modular storage products designed to be moved from rental to rental. All of which means that those at the top have to make even more dramatic transformations to keep their lavish homes ahead of the pack. Lisa Adams, the owner of LA Closet Design, whose projects start at $50,000 and can easily exceed $1 million, told me her clients’ closets might be better described as “glamour compounds.” Sometimes they’re two or three stories; sometimes they have their own elevators; and sometimes, as was the case with one Houston client, they become the central showpiece at house parties, more brass ring than practical storage solution.

When Adams started her business in 2007, she said, people wanted a lot of cabinetry—drawers and doors to hide all their stuff. Now the trend has reversed, and she finds much of her design inspiration in the places from whence her clients’ wardrobes came: luxury stores. “I’ll tell clients, ‘Ultimately, you want to feel like you’re shopping in your own closet,’ ” she said. For people with extensive wardrobes, the ways that stores display inventory can be genuinely useful. But the concerns are not purely practical. “There’s a reason why people like to shop in boutiques,” Adams said. “The good lighting, things having a place, it’s uncluttered, there’s seating, there’s champagne—it’s just the whole feeling.”

In other words, extreme closets may be starting to resemble those of, say, 16th-century Europe: a collection of prized things on loving display, a comfortable seating area in the innermost sanctum of one’s home, maybe a little desk area to work in solitude. “It’s about being proud of your space, feeling really good and calm in your space,” Adams said. Just like the Renaissance-era closet enthusiasts—though they probably lacked a wine or coffee station.

Maybe it’s not so surprising that the earliest closets and the latest ones are linked across hundreds of years of existence and many physical iterations. In human history, the pursuit of personal space and privacy has motivated people to do far stranger things than put some shelving, a mini-fridge, and a club chair in the extra bedroom they rarely use; it was among the primary reasons for the establishment of the suburbs themselves.

In that way, the American closet’s expansion is the physical consequence of so many things about modern life in this country: the everyday attempts of regular people to reconcile an endless stream of new and improved consumer goods with their space and budget; to figure out whether they actually need—or even want—the things and ideas that are marketed to them; to have a room entirely of one’s own.

I don’t know if a closet can do all that. I do know, though, that once you hang up all your clothes, they provide a pretty good acoustic barrier to the noise of the outside world. I also know how isolating the realization of our desires can sometimes turn out to be.

This article appears in the May 2021 print edition with the headline “The Boutique in Your Bedroom.”

Amanda Mull is a staff writer at The Atlantic.

4 Major Reasons Households in Forbearance Won’t Lose Their Homes to Foreclosure

There has been a lot of discussion as to what will happen once the 2.3 million households currently in forbearance no longer have the protection of the program. Some assume there could potentially be millions of foreclosures ready to hit the market. However, there are four reasons that won’t happen.

1. Almost 50% Leave Forbearance Already Caught Up on Payments

According to the Mortgage Bankers Association (MBA), data through March 28 show that 48.9% of homeowners who have already left the program were current on their mortgage payments when they exited.

- 26.6% made their monthly payments during their forbearance period

- 14.7% brought past due payments current

- 7.6% paid off their loan in full

This doesn’t mean that the over two million still in the plan will exit exactly the same way. It does, however, give us some insight into the possibilities.

2. The Banks Don’t Want the Houses Back

Banks have learned lessons from the crash of 2008. Lending institutions don’t want the headaches of managing foreclosed properties. This time, they’re working with homeowners to help them stay in their homes.

As an example, about 50% of all mortgages are backed by the Federal Housing Finance Agency (FHFA). In 2008, the FHFA offered 208,000 homeowners some form of Home Retention Action, which are options offered to a borrower who has the financial ability to enter a workout option and wants to stay in their home. Home retention options include temporary forbearances, repayment plans, loan modifications, or partial loan deferrals. These helped delinquent borrowers stay in their homes. Over the past year, the FHFA has offered that same protection to over one million homeowners.

Today, almost all lending institutions are working with their borrowers. The report from the MBA reveals that of those homeowners who have left forbearance,

- 35.5% have worked out a repayment plan with their lender

- 26.5% were granted a loan deferral where a borrower does not have to pay the lender interest or principal on a loan for an agreed-to period of time

- 9% were given a loan modification

3. There Is No Political Will to Foreclose on These Households

The government also seems determined not to let individuals or families lose their homes. Bloomberg recently reported:

“Mortgage companies could face penalties if they don’t take steps to prevent a deluge of foreclosures that threatens to hit the housing market later this year, a U.S. regulator said. The Consumer Financial Protection Bureau (CFPB) warning is tied to forbearance relief that’s allowed millions of borrowers to delay their mortgage payments due to the pandemic…mortgage servicers should start reaching out to affected homeowners now to advise them on ways they can modify their loans.”

The CFPB is proposing a new set of guidelines to ensure people will be able to retain their homes. Here are the major points in the proposal:

- The proposed rule would provide a special pre-foreclosure review period that would generally prohibit servicers from starting foreclosure until after December 31, 2021.

- The proposed rule would permit servicers to offer certain streamlined loan modification options to borrowers with COVID-19-related hardships based on the evaluation of an incomplete application.

- The proposal rule wants temporary changes to certain required servicer communications to make sure borrowers receive key information about their options at the appropriate time.

A final decision is yet to be made, and some do question whether the CFPB has the power to delay foreclosures. The entire report can be found here: Protections for Borrowers Affected by the COVID-19 Emergency Under the Real Estate Settlement Procedures Act (RESPA), Regulation X.

4. If All Else Fails, Homeowners Will Sell Their Homes Before a Foreclosure

Homeowners have record levels of equity today. According to the latest CoreLogic Home Equity Report, the average equity of mortgaged homes is currently $204,000. In addition, 38% of homes do not have a mortgage, so the level of equity available to today’s homeowners is significant.

Just like the banks, homeowners learned a lesson from the housing crash too.

“In the same way that grandparents and great grandparents were shaped by the Great Depression, much of the public today remembers the 2006 mortgage meltdown and the foreclosures, unemployment, and bank failures it created. No one with any sense wants to repeat that experience…and it may explain why so much real estate equity remains mortgage-free.”

What does that mean to the forbearance situation? According to Black Knight:

“Just one in ten homeowners in forbearance has less than 10% equity in their home, typically the minimum necessary to be able to sell through traditional real estate channels to avoid foreclosure.”

Bottom Line

The reports of massive foreclosures about to come to the market are highly exaggerated. As Ivy Zelman, Chief Executive Officer of Zelman & Associates with roughly 30 years of experience covering housing and housing-related industries, recently proclaimed:

“The likelihood of us having a foreclosure crisis again is about zero percent.”