Owning a Home Is Still More Affordable Than Renting One

If spending more time at home over the past year is making you really think hard about buying a home instead of renting one, you’re not alone. You may be wondering, however, if the dollars and cents add up in your favor as home prices continue to rise. According to the experts, in many cases, it’s still more affordable to buy a home than rent one. Here’s why.

ATTOM Data Solutions recently released the 2021 Rental Affordability Report, which states:

“Owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in 572, or 63 percent of the 915 U.S. counties analyzed for the report.

That has happened even though median home prices have increased more than average rents over the past year in 83 percent of those counties and have risen more than wages in almost two-thirds of the nation.”

How is this possible?

The answer: historically low mortgage interest rates. Todd Teta, Chief Product Officer with ATTOM Data Solutions, explains:

“Home-prices are rising faster than rents and wages in a majority of the country. Yet, home ownership is still more affordable, as amazingly low mortgage rates that dropped below 3 percent are helping to keep the cost of rising home prices in check.”

In 2020, mortgage rates reached all-time lows 16 times, and so far, they’re continuing to hover in low territory this year. These low rates are a big factor in driving affordability. Teta also notes:

“It’s startling to see that kind of trend. But it shows how both the cost of renting has been relatively high compared to the cost of ownership and how declining interest rates are having a notable impact on the housing market and home ownership. The coming year is totally uncertain, amid so many questions connected to the Coronavirus pandemic and the broader economy. But right now, owning a home still appears to be a financially-sound choice for those who can afford it.”

Bottom Line

If you’re considering buying a home this year, let’s connect today to discuss the options that match your budget while affordability is in your favor.

Will Forbearance Plans Lead to a Tsunami of Foreclosures?

At the onset of the economic disruptions caused by the COVID pandemic, the government quickly put into place forbearance plans to allow homeowners to remain in their homes without making their monthly mortgage payments. Today, almost three million households are actively in a forbearance plan. Though 29.4% of those in forbearance have continued to stay current on their payments, many have not.

Yanling Mayer, Principal Economist at CoreLogic, recently revealed:

“A distributional analysis of forborne loans’ payment status reveals that more than one third (39.1%) of all forborne loans are now 150+ days behind payment, while as many as 1-in-4 (25.5%) are 180+ days past due.”

These homeowners have been given permission to not make their payments, but the question now is: how many of them will be able to catch up after their forbearance program ends? There’s speculation that a forthcoming wave of foreclosures could be the result, and that could lead to another crash in home values like we saw a decade ago.

However, today’s situation is different than the 2006-2008 housing crisis as many homeowners have tremendous amounts of equity in their homes.

What are the experts saying?

Over the last 30 days, several industry experts have weighed in on this subject.

Michael Sklarz, President at Collateral Analytics:

“We may very well see a meaningful increase in the number of homes listed for sale as these borrowers choose to sell at what is arguably an intermediate top in the market and downsize to more affordable homes rather than face foreclosure.”

Odeta Kushi, Deputy Chief Economist at First American:

“The foreclosure process is based on two steps. First, the homeowner suffers an adverse economic shock…leading to the homeowner becoming delinquent on their mortgage. However, delinquency by itself is not enough to send a mortgage into foreclosure. With enough equity, a homeowner has the option of selling their home, or tapping into their equity through a refinance, to help weather the economic shock. It is a lack of sufficient equity, the second component of the dual trigger, that causes a serious delinquency to become a foreclosure.”

Don Layton, Senior Industry Fellow at the Joint Center for Housing Studies of Harvard University:

“With a greater cushion of equity, troubled homeowners have dramatically improved options: a greater ability to access funding (e.g. home equity lines) to keep paying monthly expenses until family finances might recover, improved ability to qualify for and support a loan modification, and, if push comes to shove, the ability to sell the home and monetize their increased net worth while reducing monthly payment obligations. So, what should lenders and servicers expect: a large number of foreclosures or only a modest increase? I believe the latter.”

With today’s positive equity situation, many homeowners will be able to use a loan modification or refinance to stay in their homes. If not, some will go to foreclosure, but most will be able to sell and walk away with their equity.

Won’t the additional homes on the market impact prices?

Distressed properties (foreclosures and short sales) sell at a significant discount. If homeowners sell instead of going into foreclosure, the impact on the housing market will be much less severe.

We must also realize there is currently an unprecedented lack of inventory on the market. Just last week, realtor.com explained:

“Nationally, the number of homes for sale was down 39.6%, amounting to 449,000 fewer homes for sale than last December.”

It’s important to remember that there weren’t enough homes for sale even then, and inventory has only continued to decline.

The market has the potential to absorb half a million homes this year without it causing home values to depreciate.

Bottom Line

The pandemic has led to both personal and economic hardships for many American households. The overall residential real estate market, however, has weathered the storm and will continue to do so in 2021.

Why Right Now May Be the Time to Sell Your House

The housing market made an incredible recovery in 2020 and is now positioned for an even stronger year in 2021. Record-low mortgage interest rates are a driving factor in this continued momentum, with average rates hovering at historic all-time lows.

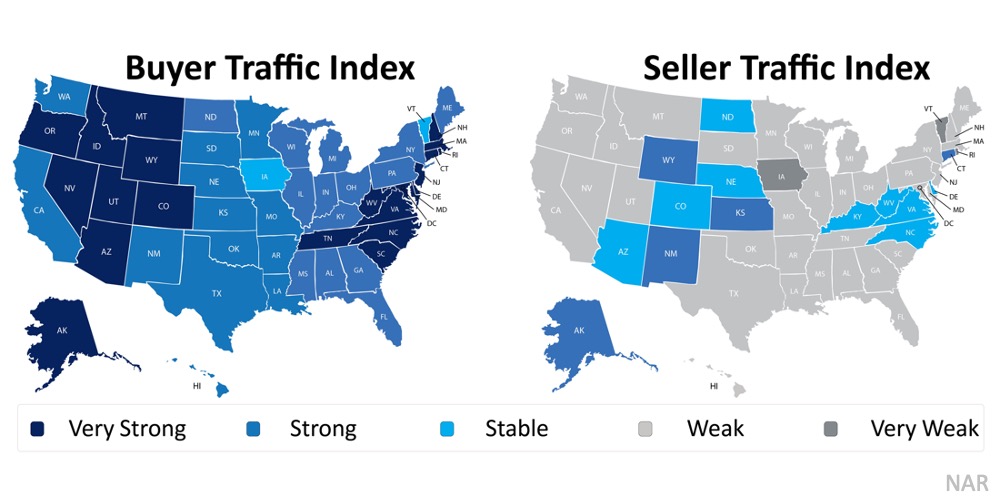

According to the latest Realtors Confidence Index Survey from the National Association of Realtors (NAR), buyer demand across the country is incredibly strong. That’s not the case, however, on the supply side. Seller traffic is simply not keeping up. Here’s a breakdown by state:As the maps show, buyer traffic is high, but seller traffic is low. With so few homes for sale right now, record-low inventory is creating a mismatch between supply and demand.

NAR also just reported that the actual number of homes currently for sale stands at 1.28 million, down 22% from one year ago (1.64 million). Additionally, inventory is at an all-time low with 2.3 months supply available at the current sales pace. In a normal market, that number would be 6.0 months of inventory – significantly higher than it is today.

What does this mean for buyers and sellers?

Buyers need to remain patient in the search process. At the same time, they must be ready to act immediately once they find the right home since bidding wars are more common when so few houses are available for sale.

Sellers may not want to wait until spring to put their houses on the market, though. With such high buyer demand and such a low supply, now is the perfect time to sell a house on optimal terms.

Bottom Line

The real estate market is entering the year like a lion. There’s no indication it will lose that roar, assuming inventory continues to come to market.

What Does 2021 Have in Store for Home Values?

According to the latest CoreLogic Home Price Insights Report, nationwide home values increased by 8.2% over the last twelve months. The dramatic rise was brought about as the inventory of homes for sale reached historic lows at the same time buyer demand was buoyed by record-low mortgage rates. As CoreLogic explained:

“Home price growth remained consistently elevated throughout 2020. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

While the pandemic left many in positions of financial insecurity, those who maintained employment and income stability are also incentivized to buy given the record-low mortgage rates available; this is increasing buyer demand while for-sale inventory is in short supply.”

Where will home values go in 2021?

Home price appreciation in 2021 will continue to be determined by this imbalance of supply and demand. If supply remains low and demand is high, prices will continue to increase.

Housing Supply

According to the National Association of Realtors (NAR), the current number of single-family homes for sale is 1,080,000. At the same time last year, that number stood at 1,450,000. We are entering 2021 with approximately 370,000 fewer homes for sale than there were one year ago.

However, there is some speculation that the inventory crush will ease somewhat as we move through the new year for two reasons:

1. As the health crisis eases, more homeowners will be comfortable putting their houses on the market.

2. Some households impacted financially by the pandemic will be forced to sell.

Housing Demand

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. Today, we’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year.

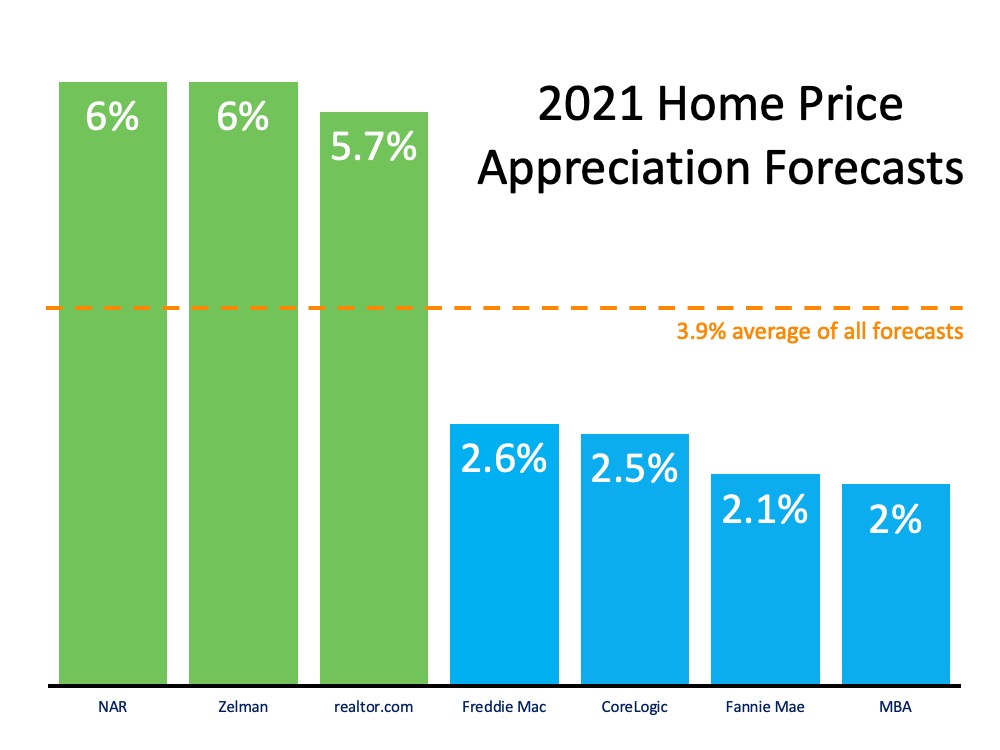

Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

Bottom Line

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate.

Real Estate Fact Friday

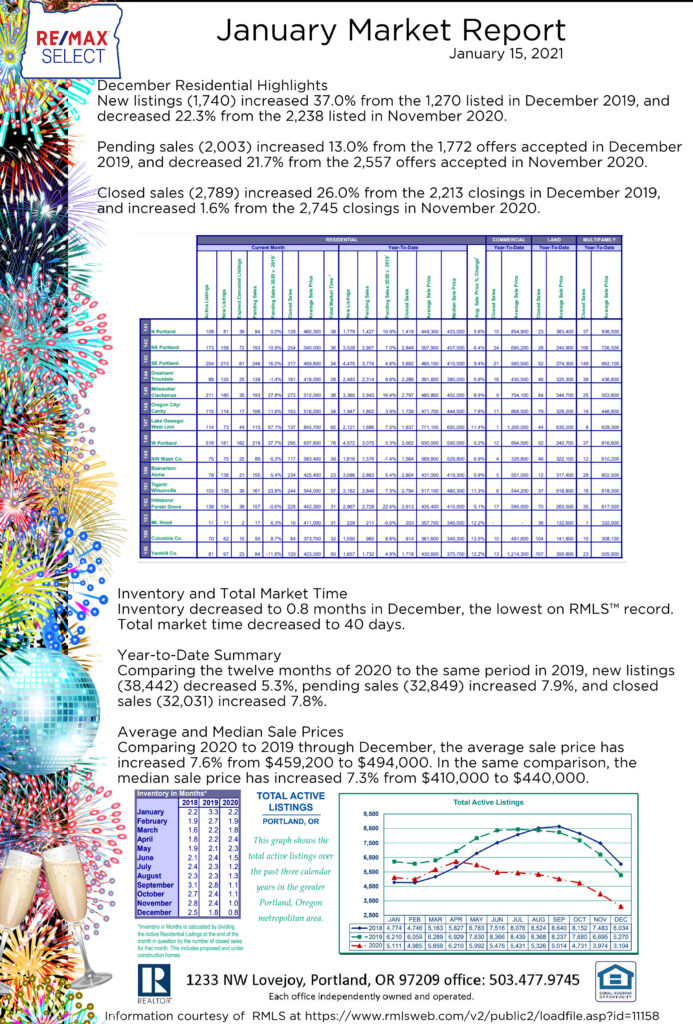

The January Market Report is Bananas!

More than 100 new affordable apartments greenlit for N. Portland neighborhood

Updated Jan 14, 2021; Posted Jan 13, 2021

By Shane Dixon Kavanaugh | The Oregonian/OregonLive

https://www.oregonlive.com/news/2021/01/more-than-100-new-affordable-apartments-greenlit-for-n-portland-neighborhood.html

The Portland City Council greenlit funding Wednesday for an affordable housing project that will bring more than 100 new apartments with low and very low rent to the St. Johns neighborhood.

The unanimously approved measure will provide about $17.4 million in Portland housing bond revenue for Cathedral Village, whose construction in the 8600 block of North Crawford Street will begin this year.

With sweeping views of the nearby St. Johns Bridge, the four-story, 110-unit building will offer low-income Portlanders a place to live within walking distance of grocery stores, public transit and Cathedral Park, city officials

More than half the apartments will have two or three bedrooms, a size geared toward families, documents show. Two-thirds will be available to Portlanders who earn up to 60% of the city’s median income while the rest will be reserved for those who earn 30% or less.

For a family of four, those figures were $55,260 and $27,640, respectively, last year, according to the Portland Housing Bureau.

The development, which carries a total price tag of just over $38 million, is a collaboration between non-profit Catholic Charities of Oregon and for-profit Related Northwest.

Its pending ground-breaking comes two months after developers Northwest Related and Central City Concern began construction on the Crescent Court Apartments, a $40.7 million, 138-unit affordable housing project in the 11500 block of Southeast Division Street.

— Shane Dixon Kavanaugh; 503-294-7632

Email at [email protected]

Follow on Twitter @shanedkavanaugh

Real Estate Facts

I think we need to catch up on some fun real estate facts in order to de-stress, don’t you?

Final Drone Rules Released

On December 28, 2020, the FAA released new final rules for certain uses of Unmanned Aerial Systems, (UAS, or drones), the result of a multi-year undertaking. These new rules build upon previous rulemakings which expanded UAS operations to allow for commercial use and eased restrictions for those operators, along with creating the small-UAS (less than 55 lbs) and micro-UAS (4.4. lbs or less) categories of vehicles. The new regulations do several things: 1) they require remote identification technology for UAS; 2) they expand UAS commercial operations to allow for over-crowd flights, creating different restrictions based on the category the UAS falls into (more below); and 3) they establish a system for allowing operators to conduct UAS flights at night.

Previously, the FAA had allowed commercial UAS flights only over people on the ground who were participants in the operation itself. Under the new regime, certain types of UAS will be able to fly over crowds regardless of their knowledge or participation in the operations; others will have more restricted abilities. To accomplish this, the FAA created new categories for UAS:

Category 1: The only category based solely on weight. It is for UAS weighing .55 lbs or less. These UAS can fly over crowds regardless of if they are participating in the operation or not, as long as remote identification technology has been enabled.

Categories 2 – 4 are UAS that weigh more than .55 lbs and meet certain FAA safety standards, with the standards for Category 2 being highest, then Category 3, and finally Category 4. As the standards are lowered by category, the limitations on what those UAS can do are raised.

Category 2: Can fly over crowds, but not over open air assemblies.

Category 3: Can fly over people participating in the operation or within an enclosed/restricted space and the people within have been notified that a UAS may fly over them.

Category 4: Requires an “airworthiness certificate” from the FAA (Part 21), and is restricted to operations allowed according to it.

In addition, UAS Categories 1-3, if eligible to fly over people, can operate over moving vehicles when in transit (sustained flights over moving vehicles are prohibited).

The new rule also allows for commercial small-UAS (less than 55 lbs) flights at night. To fly at night, remote pilots must either complete an updated initial test or the updated recurrent online training prior to conducting a night operation. In addition, their small-UAS must be equipped with operational anti-collision lights that can be seen for 3 statute miles and have a flash rate sufficient to avoid a collision.

These updated rules expand the legal operational capabilities of commercial UAS and provide flexibility for operators who use them in their businesses, including real estate professionals. The FAA continues to work on regulations to allow for commercial UAS flights that go “beyond-visual-line-of-sight” (BVLOS). NAR will continue to work with the FAA to develop UAS regulations and advocate for common-sense rules which allow UAS to meet their full potential for real estate professionals while protecting the safety and privacy of people on the ground.

Read the new FAA regulations executive summary(link is external)

Get information on Remote Identification requirements(link is external)

Read the over-crowds and night flights rule(link is external)

Read the remote identification technology rule